MARKETERS CONSULT FOREIGN TRADERS FOR CHEAPER FUEL IMPORTS

Oil marketers say they have commenced negotiations with international traders to import cheaper Premium Motor Spirit (petrol) into Nigeria to remain competitive in the business. This is even as the Independent Petroleum Marketers Association of Nigeria and oil workers insisted that the price of petrol from the Dangote Petroleum Refinery should be cheaper than N825 per litre. Speaking with our correspondent, the marketers complained of price volatility caused by Dangote refinery’s repeated price cuts, saying the only way to get petrol at a lower price was to strike deals with foreign traders while hoping the Nigerian National Petroleum Company Limited would resume refining activities soon. In an interview with our correspondent, the National President of the Petroleum Products Retail Outlet Owners Association of Nigeria, Billy Gillis-Harry, said an arrangement is ongoing, describing it as the only means to get affordable petrol. Gillis-Harry said prices from domestic refiners were worrisome, a development that led to the shutdown of many filling stations. “How do you get cheaper fuel? It is only by arrangement. We are not refining, and those who are refining are giving us prices that are a bit worrisome in the way the prices are being skewed. You can see that so many filling stations don’t have products because they don’t have the money to buy, as the money to do business has evaporated. “So, of course, marketers will have to find a way to buy what we need to buy. The only way we can do it is to collaborate and buy products from a very dependable importer. That’s the only way we can do it,” he said. According to him, PETROAN once reached an agreement with a foreign trader to import petrol at the rate of N550 per litre, adding that the transaction would be in naira instead of dollars. Asked if this was possible, the PETROAN boss replied, “Of course, it’s possible. For instance, before we stopped our importation scheme, we were already negotiating with people to sell us products for as low as N550. That was November 2024; N550 per litre. That’s what we were negotiating. Any day I see you, I will show it to you; I can’t send you confidential economic documents. Any day you see me, ask me, and I’ll show you the offers that were given to us from different parts of the world. “As it is today, I think the only way we can really reduce costs is to make sure that the profit margins are extremely low and we buy in Nigerian naira, not in dollars,” he added. On whether the international traders are ready to sell in naira, he said the power of negotiation and large numbers would convince them. “It is negotiation. That is the power of numbers. That’s why PETROAN can do that because we have the numbers to determine how our businesses can come. “But now, we have to make sure that we get it right. We supported local refining with all our hearts, but look at what local refining is doing to us. We can’t even be in business. You buy the product today at N870, and before you reach your station, it has been reduced to N825. From N825, you are looking at how it increases to N890. From N890, it comes down to N865. Those kinds of movements that are not clearly determined are a challenge,” he stressed. Our correspondent asked the retailer to clarify if he was also of the opinion that Dangote refinery’s fuel was not cheap enough, but he retorted that he was not referring to Dangote.

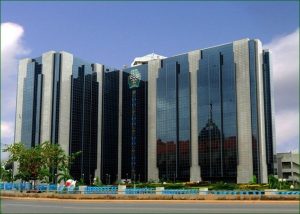

NGX SHEDS N121BN AS INVESTORS REACT TO CBN’S DIRECTIVE

The Nigerian Exchange Limited began the new trading week on a bearish note as the market capitalisation declined by N121bn, driven largely by sell-offs in banking stocks following a directive from the Central Bank of Nigeria. The directive, which suspended dividend payments, bonuses, and new foreign investments by banks operating under regulatory forbearance, triggered panic selling among investors, leading to a sharp downturn in key market indicators. At the close of trading on Monday, the All-Share Index depreciated by 170.77 points, representing a 0.15 per cent decline, to close at 115,258.77 points. This was down from 115,429.54 points recorded at the end of trading last Friday. Consequently, the overall market capitalisation dropped from N72.82tn to N72.70tn, marking a day-on-day loss of N121bn. The CBN’s recent circular outlined measures to strengthen the banking sector’s capital base amid ongoing regulatory reviews. It directed banks currently benefiting from forbearance, especially on credit exposures and Single Obligor Limits, to suspend dividend payments to shareholders, defer bonuses to directors and senior management staff, and halt investments in foreign subsidiaries or new offshore ventures. The suspension will remain in effect until these banks exit the regulatory forbearance regime fully and their capital adequacy and provisioning levels are independently verified to be compliant with prevailing regulatory standards.Market participants reacted swiftly and negatively to the circular, resulting in a widespread sell-off, particularly in the banking sector, which weighs heavily on the NGX indices. Of the 125 equities traded, only 21 recorded gains, while 43 closed in the red. Despite this negative short-term performance, the market has demonstrated resilience over a longer timeframe, with a one-week gain of 2.2 per cent, a four-week increase of 5.68 per cent, and a year-to-date appreciation of 11.98 per cent. The volume of shares traded on Monday amounted to 721.75 million across 22,100 deals, with a turnover value of N22.01bn. This reflected a 23 per cent decline in trading volume from the previous session but showed a 23 per cent improvement in turnover and an eight per cent increase in the number of deals. Leading the gainers on Monday was Guinea Insurance, which rose by ten per cent to close at N0.77 per share. Other significant gainers included Ellah Lakes, which appreciated by 9.93 per cent to N4.76; Legend Internet, up 9.87 per cent to N7.79; Royal Exchange, gaining 9.68 per cent to N1.02; Fidson Healthcare, increasing by 9.64 per cent to N42.10; and the NGX Group, which added 9.09 per cent to close at N42.00 per share. On the losing side, Northern Nigeria Flour Mills was the biggest decliner, with its share price dropping by ten per cent to N101.30. C&I Leasing followed, losing 9.68 per cent to close at N4.20. Other major losers included University Press, down 9.27 per cent to N4.99; Deap Capital Management and Trust, which declined by 8.99 per cent to N0.81; Learn Africa, down 8.43 per cent to N3.80; and Access Holdings, which shed 8.28 per cent to close at N20.50 per share. In terms of trading volumes, Access Holdings led with 92.7 million shares exchanged, followed by United Bank for Africa with 91.4 million, Zenith Bank with 76.8 million, and Fidelity Bank with 50 million shares traded.

CASH CRUNCH LOOMS OVER CBN’S 50% CRR ON BANKS – REPORT

Ahead of next month’s Monetary Policy Committee meeting, a new research note by Renaissance Capital has revealed that Nigeria’s banking sector is facing a severe liquidity crunch following the Central Bank of Nigeria’s decision to impose a 50 per cent Cash Reserve Ratio, a move analysts say is at odds with the country’s ambition of achieving a $1tn economy by 2030. A new report by investment bank, Renaissance Capital, has warned that the higher CRR requirement, described as the highest in the world, has significantly restricted banks’ ability to lend, threatening credit growth and turning market sentiment on Nigerian banks from bullish to bearish in the short term. The research notes, seen by The PUNCH on Tuesday, said, “In our view, the CBN’s decision to raise the Cash Reserve Ratio to 50 per cent while simultaneously mandating banks recapitalize to support lending for a $1tn economy by 2030 appears contradictory. While the recapitalisation directive aims to strengthen banks’ capacity to lend, the 50 per cent CRR severely restricts their ability to deploy funds, effectively undermining the policy’s intent. “The feasibility of the $1tn GDP target is questionable, given that a core rationale for recapitalisation was to spur credit growth, an outcome now constrained by the CRR’s liquidity drain. With CRR at 50 per cent and the liquidity ratio at 30 per cent, banks are left with only 20 per cent of customer deposits available for lending, well below the regulatory Loan-to-Deposit Ratio benchmark of 50 per cent. “This structural limitation makes it challenging for banks to meet domestic lending targets, even with higher capital buffers. Notably, banks currently maintaining LDRs above 20 per cent are likely doing so through deposits sourced from international operations, which remain unaffected by the CBN’s domestic CRR policy. This policy mix creates conflicting incentives. While recapitalisation seeks to expand lending capacity, the CRR hike stifles liquidity, forcing banks to prioritise balance sheet management over credit expansion. Unless adjusted, these measures risk stifling the very growth they were designed to support.” According to Renaissance Capital, the CBN’s simultaneous push for bank recapitalisation to support lending capacity and its aggressive liquidity mop-up through the 50 per cent CRR presents a conflicting policy stance. “While the recapitalisation directive aims to strengthen banks’ capacity to lend, the 50 per cent CRR severely restricts their ability to deploy funds, effectively undermining the policy’s intent,” the report stated.

FG RAISES N4BN FROM JUNE SAVINGS BOND OFFER

The Federal Government of Nigeria has raised a total of N4.01bn from its June 2025 Savings Bond issuance, according to the allotment results released by the Debt Management Office on Wednesday. The offer, which ran from June 2 to June 6, 2025, comprised two tranches: a two-year bond due in June 2027 with a coupon rate of 16.121 per cent and a three-year bond due in June 2028 with a coupon rate of 17.121 per cent. For the two-year bond, the government allotted N2.01bn across 1,202 successful subscriptions, while the three-year bond attracted 1,321 successful investors, with an allotment value of N1.995bn. Both instruments have a settlement date of June 11, 2025, and will pay coupons quarterly, on September 11, December 11, March 11, and June 11 of every year until maturity. The Federal Government Savings Bond is part of efforts to deepen the domestic debt market and ensure the participation of small-scale investors in national development. The PUNCH reported that the Debt Management Office has allotted N4.3bn worth of Federal Government Savings Bonds in its May 2025 offer.

STOCK MARKET RECORDS N1.18TRN GAIN AS SEPLAT, OTHERS LEAD

The Nigerian stock market rebounded on Wednesday after a two-day loss, as investors gained N1.184 trillion. Market capitalisation rose by N1.184 trillion, or 1.63 per cent, to close at N73.681 trillion, up from N72.497 trillion recorded on Tuesday. Similarly, the All-Share Index rose by 1,876.71 points, or 1.63 per cent, settling at 116,786.87 from its previous close of 114.910.16. This uptrend was fueled by strong buying interest in medium and large-capitalised stocks including NEM Insurance, Beta Glass, Seplat, Linkage Assurance and 34 other stocks. The market breadth closed positively, with 38 gainers and 32 losers. NEM Insurance led the advancers’ chart increasing by 10 per cent, settling at N16.50 while Beta Glass rose by 9.99 per cent, finishing at N250.95 per share. Seplat Energy gained by 9.79 per cent, closing at N5,450 and Thomas Wyatt Nigeria grew by 9.73 per cent, ending the session at N2.03 per share. Similarly, Linkage Assurance soared by 9.56 per cent, closing at N1.49 per share. On the flip side, FG132026S1 dropped by 17.70 per cent, ending the session at N80 while Eterna fell by 10 per cent, closing at N38.70 per share. Secure Electronic Technology lost by 9.68 per cent, settling at 56k and Legend Internet declined by 9.66 per cent, finishing at N6.55 per share. Also, FTN Cocoa Processors shed by 6.07 per cent, closing at N2.63 per share. Total turnover stood at 640.08 million shares valued at N26.01 billion, traded across 19,727 deals. This is compared to 787.31 million shares valued at N25.67 billion, traded across 23,170 transactions. Transactions in the shares of Zenith Bank topped the activity chart with 149.92 million worth N7.21 billion. Access Corporation followed with 48.64 million shares valued at N1.01 billion while United Bank for Africa traded 42.99 million shares worth N1.46 billion. Nigerian Breweries transacted 37.72 million shares valued at N2.19 billion while Fidelity Bank sold 30.84 million shares worth N568.54 million.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026