FG GENERATES N5.21TN FROM OIL SALES IN H1

The Federal Government, through the Nigerian Upstream Petroleum Regulatory Commission, raked in N5.21tn from the sale of crude oil, gas and other economic activities in the first six months of 2025. It said the revenue inflow represents 42.7 per cent of the record N12.2tn it generated in the entire 2024 fiscal year. The figure, however, represents only 34.7 per cent of the N15tn revenue target set by the Federal Government for the commission to meet to implement the 2025 budget. The revenue was derived from royalties, gas sales, flared gas penalties, and joint venture proceeds. Revenue inflow obtained from the commission’s latest report submitted at the Federation Accounts Allocation Committee meeting document revealed that the January to June 2025 earnings include payments from Nigerian National Petroleum Company Limited joint venture and production sharing contract royalty receivables totalling N1.04tn for the period. Also included is N315.93bn from the controversial Project Gazelle receipts for January and March 2025, with no inflows recorded in December 2024, February, April, May, and June 2025. The report read, “Revenue Performance: The commission’s performance from January to June 2025 is N5.21tn which is inclusive of NNPC Ltd JV & PSC Royalty Receivables of N1.04tn for the period of January to June 2025 and Project Gazelle receipt of N315.93bn for November 2024 (received in January 2025).” In addition, NNPC’s JV royalty receivables from October 2022 to June 2025 amounted to N6.60tn, reflecting the cumulative impact of delayed remittances from oil companies. To ensure the smooth operations of the 2025 budget, the commission said it is targeting N15tn revenue this year. The NUPRC Chief Executive, Gbenga Komolafe, confirming the target, said, “And we all know the importance of that; we’re ramping up federal revenue. Last year, that is for 2024, you remember that the commission achieved and surpassed its revenue generation by about 163 per cent. This year, our target has been increased to about N15tn. “So, the commission, recognising that, we have equally devised a strategy. Of course, N15tn is so large, but then we are not daunted; we are not intimidated. Rather, we are defining a strategic approach to achieve that target.” The report also confirmed the recovery of $459,226 from outstanding obligations, part of a cumulative debt of $1.436bn from various crude oil lifting contracts, leaving a balance of $1.435bn. The NUPRC noted that the recovered sum was part of the revenue-sharing reconciliation between NNPCL and the Federation, overseen by the Technical Sub-Committee of the Alignment Committee on the Reconciliation of Indebtedness. The commission’s mid-year revenue trails the proportional benchmark compared to its N12.25tn actual earnings for the whole of 2024. At the current pace, revenues could end the year below target unless oil output increases significantly and arrears payments accelerate. Industry experts cautioned the Federal Government against turning the NUPRC into a primarily revenue-generating agency, warning that excessive taxation and an unfriendly business climate could further drive away investment from the nation’s oil and gas sector. Speaking in separate interviews with The PUNCH, an energy analyst, Dayo Ayoade, and a petroleum engineer, Bala Zaka, said the government risked “killing the goose that lays the golden eggs” if it prioritised revenue collection over creating a stable, investor-friendly regulatory environment. Ayoade, a lecturer and energy policy analyst, explained that while revenue generation was critical to national development, conflating regulatory oversight with aggressive revenue mobilisation could distort the NUPRC’s mandate. “Revenue generation is always going to be a taxation issue; people have to pay their dues and taxes. But when you make a regulator a revenue-generating agency, that becomes problematic,” he said. “The job of the NUPRC is essentially to be the technical and commercial regulator of the upstream oil and gas sector. They are not the FIRS and are not a revenue-generating company. Under the Petroleum Industry Act, the commission collects fees and payments from oil and gas companies for government revenue, but it must balance this with its regulatory responsibilities.” He warned that excessive fiscal pressure on oil companies could lead to disinvestment, as firms relocate to friendlier jurisdictions. “If the regulator focuses too much on extracting money from companies, it could injure or even kill the goose that lays the eggs. International oil companies might decide Nigeria is no longer worth the trouble and move to other countries with safer regulatory climates,” he said. “If regulation suffers because of the obsession with revenue, the whole country will suffer in the long run.” On his part, Zaka blamed the current revenue challenges in the oil sector on years of “business climate hostilities”, which, he said, had driven many international players out of the country. “When we talk about revenue generation, you look at different sectors, but in Nigeria, the oil sector is the principal source. Unfortunately, the industry has been experiencing hostilities for years, and now the chickens have come home to roost,” he said. According to him, divestments by multinationals were not simply portfolio adjustments as claimed by the government at the time, but a direct reaction to harassment, sabotage, community extortion, and rising security costs. “These companies moved to East Africa, where they are now drilling and exploring in new areas. Meanwhile, the indigenous firms that took over onshore and shallow-water facilities are not aggressively exploring or building reserves. They are content with the money they are making without increasing production,” he said. Zaka noted that production shortfalls had inevitable consequences for government revenue. “If production is high, you make more revenue. But because hostilities persisted in places like Warri, companies relocated to Port Harcourt, and now some are even moving to Lagos. The truth about our revenue generation ability was always going to come out, and now we are seeing it physically,” he added. Both experts urged the government to focus on improving security, reducing regulatory bottlenecks, and incentivising exploration if it wants to sustainably grow oil revenue without crippling the sector’s future.

STATES HIT BY 68% SPIKE IN FOREIGN DEBT PAYMENTS

States collectively spent about N235.58bn on servicing external debt obligations in the first half of 2025, The PUNCH reports. This is according to an analysis of the data from the Federal Account Allocation Committee disbursement released by the National Bureau of Statistics. The amount represents a sharp increase of N95.65bn or 68.4 per cent when compared with the N139.92bn recorded in the corresponding period of 2024, showing the mounting pressure of dollar-denominated debt repayments on state finances in the wake of the naira’s depreciation. It is crucial to note that the Federal Government undertakes external debt servicing on behalf of the states through an Irrevocable Standing Payment Order arrangement, which authorises automatic deductions from their monthly FAAC allocations. Under this process, once an external loan has been approved and a subsidiary agreement executed, the Office of the Accountant-General of the Federation, working with the Federal Ministry of Finance and the Central Bank of Nigeria, deducts the agreed debt service amount before releasing allocations to the states. According to an analysis of data done by The PUNCH, January 2025 began with a hefty outflow of N40.09bn towards external debt servicing, a sum that dwarfs the N9.88bn paid in the same month of 2024. This represented a year-on-year jump of more than 305 per cent and was the highest single-month repayment in the first half of the year. In February, the states collectively paid N39.10bn, a figure which, although slightly lower than January’s, was still markedly higher than the N24.53bn disbursed in February 2024, representing a 59.5 per cent increase. March 2025 recorded the same N39.10bn, marginally lower than the N40.41bn paid in March 2024, reflecting the unusual spike that occurred in that month last year when some states made large payments to clear maturing obligations. From April to June 2025, the pattern remained unchanged, with each month posting exactly N39.10bn in debt servicing outflows, suggesting relative stability of the local currency in the second quarter of 2025. This represents an 80.1 per cent rise compared with the N21.70bn paid in each of those months in 2024. Lagos State, long acknowledged as the country’s economic nerve centre, retained its position as the single largest contributor to the overall debt servicing bill, remitting a total of N49.58bn in the first six months of 2025. This marks a 52.8 per cent increase from the N32.44bn recorded in the same period last year. The size of Lagos’s foreign debt repayment, more than double that of any other state, reflects both its long-standing borrowing profile for large-scale infrastructure projects and the impact of exchange rate weakness on dollar-linked obligations. Rivers State followed with N26.34bn, a leap from just N4.62bn in the first half of 2024, representing an increase of more than 470 per cent. Kaduna State ranked third with N24.47bn, a modest 6 per cent rise from the N23.09bn paid last year. Ogun State came fourth with N12.57bn, nearly triple the N4.29bn recorded in the first half of last year, while Edo State completed the top five with N10.18bn, a 72.6 per cent increase on the N5.90bn paid in 2024. Collectively, these five states spent N123.14bn, accounting for about 52.3 per cent of all external debt servicing payments made by the 36 states in the first half of 2025, highlighting the concentration of foreign debt exposure in a small group of subnationals. At the lower end of the scale, Jigawa State recorded the smallest external debt servicing bill at N1.39bn in the first half of 2025, a 54.3 per cent increase from N900.54m in the same period of 2024. Benue followed with N1.44bn, up 62.1 per cent from N890.16m last year, while Yobe paid N1.46bn, representing a 77.0 per cent rise from N823.59m in 2024. Borno State recorded N1.52bn, up 128.1 per cent from N668.07m, while Zamfara paid N1.56bn, 75.0 per cent higher than the N891.82m recorded in the same period last year. Plateau also featured among the states with comparatively low repayments at N1.81bn, though this was 125.8 per cent more than the N803.28m paid in 2024. While these states maintain smaller foreign loan portfolios than their higher-ranked counterparts, the sharp year-on-year increases underline the nationwide effect of exchange rate depreciation on the cost of servicing external debt. The data reveal interesting regional patterns. In the South-West, Lagos and Ogun lead, reflecting an aggressive use of foreign loans to fund infrastructure and other development projects, often at concessional rates but with significant exposure to exchange rate fluctuations. In the South-South, Rivers and Edo have both posted large increases, while Cross River remained high at N9.82bn, up 24.8 per cent from N7.87bn in 2024. In the North, Kaduna remains the largest payer, while Bauchi recorded N8.13bn in repayments, up 28.5 per cent from N6.33bn last year.

MARKET GAINS N111BN AS INSURANCE EQUITIES SURGE

The Nigerian equities market recorded a gain of N111bn on Tuesday, buoyed mainly by performances in the insurance sector. The Nigerian Exchange All-Share Index inched up by 175.10 points, or 0.12 per cent, closing at 146,055.87. This marked a one-week gain of 0.87 per cent and a year-to-date increase of 41.9 per cent. The current market capitalisation of the NGX stands at N92.4tn. A total of 77.2 million shares were traded in 31,146 deals, with a market turnover of N24.22bn. While trading volume declined by 40 per cent compared to the previous session, turnover improved by 25 per cent. In aggregate, 128 listed equities participated in trading, with 49 gainers and 30 losers by the close. Leading the gainers was AXA Mansard Insurance, which rose by 10 per cent to close at N17.71 per share. Others that recorded a 10 per cent appreciation include Champion Breweries at N17.38, Ellah Lakes at N16.06, The Initiates at N14.52, Sunu Assur at N6.05, and ABC Transport at N4.95. On the losing side, Juli Plc led with a 10 per cent decline to N9.00 per share. This was followed by Unilever Nigeria, which dropped by 9.97 per cent to N71.30; Custodian and Allied Insurance, down 9.55 per cent to N37.90; Academy Press, which declined by 7.78 per cent to N8.30; May & Baker Nigeria, down 7.69 per cent to N18.00; and Wema Bank, which lost 6.05 per cent to close at N21.75. In terms of sector indices, the Insurance Index surged 9.12 per cent, reflecting robust investor interest in the sector. Other indices posted mixed results, with the Top 30 Index up 0.03 per cent and the Industrial Index gaining 0.86 per cent. Regarding market activity, Lasaco Assurance recorded the highest volume of 107 million shares traded, followed closely by Japaul Gold and Ventures with 107 million shares, Sterling Bank with 97.8 million shares, and Aiico Insurance with nearly 65 million shares. Top value transactions were dominated by Guaranty Trust Holding Company with N2.62bn, Dangote Cement with N2.31bn, Zenith Bank with N2.02bn, and Access Bank with N1.68bn.

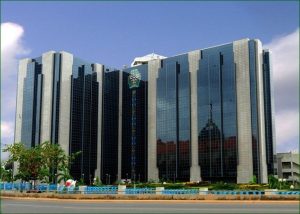

CBN SENSITISES MANUFACTURERS, OTHERS ON ALTERNATIVE PAYMENT CHANNELS

The Central Bank of Nigeria has reaffirmed its commitment to expanding financial inclusion and driving economic growth by promoting the adoption of alternative payment channels. The apex bank expressed this commitment at a sensitisation exercise termed ‘CBN Fair’ on Tuesday under the theme, ‘Driving Alternative Payment Channels as Tools for Financial Inclusion, Growth and Accelerated Economic Development.’ Present at the CBN Fair were manufacturers, commercial banks, microfinance banks, fintech/agent banks, merchant banks, students, traders, artisans, members of the National Youth Service Corps and other stakeholders. Speaking at the event, the Acting Director, Corporate Communications Department, Hakama Ali, highlighted some of the policies taken by the Olayemi-Cardoso-led management of the CBN since assuming office and noted the Central Bank is championing technologies that empower individuals, boost productivity, and connect communities to the nation’s economic opportunities. She said the theme of the fair was chosen to address the imperative of value addition and the links that catalyse SMEs and other economic activities to attain the much-needed price stability. “The management of the Central Bank of Nigeria, under the leadership of Mr Cardoso, is committed to stimulating productivity and financial inclusiveness, as well as delivering on its core mandate of monetary and price stability. This has resulted in a significant increase in the inflow of foreign investment, positive trade balances, and a quantum leap in the financial inclusion rate in recent times. Over the past 22 months, the bank has, among others, rolled out the following functional policies to strengthen the financial system:exchange rate unification – this is to minimise arbitrage opportunities and reduce volatility in the foreign exchange market. Over $7bn of verified backlog of forex forwards has also been cleared with the launch of the Nigerian Forex Code. The code is a set of principles of good practices in the Nigerian foreign exchange market based on six pillars: ethics, governance, execution, information sharing, risk management and compliance; compliance for confirmation and settlement processes; and bank recapitalisation to strengthen the resilience and global competitiveness of the banking sector, positioning it to support the $1tn economy,” Ali explained. She added, “The launch of the Non-Resident BVN to connect Nigerians abroad with home banking as a means of protecting bank customers. The CBN launched the unified complaints tracking system aimed at streamlining and improving the management of consumer complaints against financial institutions. The system, alongside the USSD code for verifying licensed institutions, enhances transparency and consumer protection in the Nigerian financial sector.” She added that the objective of the engagement was to sensitise the public to how bank services and innovations can enhance their lives and livelihoods and contribute to the growth and development of the Nigerian economy. Issuing a warning on the abuse of the naira, Ali said, “The CBN will continue to ensure availability of clean currency. We, however, urge you to see the naira as a critical symbol of our national identity, respect it, and keep it clean. Do not mutilate, counterfeit or hurt the naira.” In his welcome address, the Branch Controller, CBN Lagos, Sunday Daibo, emphasised that the apex bank is on a mission to make financial access universal and to ensure that every Nigerian, regardless of location or status, can participate in and benefit from the nation’s economic progress. “Over the years, we have seen how our mobile money platforms, agency banking networks, USSD services, internet banking, contactless payments, Central Bank, digital currency and, most recently, open banking have broken the barriers of distance, costs and complexity. These channels are more than just tools for transaction; they are instruments for empowerment. When a farmer in a remote community can receive payments instantly for produce without travelling miles to the nearest bank, when a small business can sell goods online and receive secure payments from customers anywhere in the country, when a young entrepreneur can access microloans directly from a mobile wallet, that is financial inclusion in action, and that inclusion, in turn, fuels growth and accelerates our journey towards sustainable economic development. At this fair, you will see practical demonstrations, innovative solutions, real-life stories and proof of the transformative power of alternative payment channels. You will also hear from industry experts who will share insights on policy, technology, cybersecurity and consumer protection, all of which are crucial to building trust and expanding adoption. “Our task is clear: to promote these channels, not only as efficient means of payment, but also as tools for bridging economic divides, boosting productivity and strengthening the resilience of our financial system. This requires collaboration between regulators and operators, between technology providers and consumers and between the public and private sectors.” The Director of Consumer Protection and Financial Inclusion, Dr Aisha Isa-Olatinwo, in her comments said, “The theme of the fair is apt, and why did I say that? Driving alternative payment channels as tools for financial inclusion, growth, and accelerated economic development cannot better be discussed at any time but now and always. I’m sure you will agree with me that after COVID, we now understand how very closely knitted we are, not just in Nigeria, but all over the world. And this brings us to the fact that we must begin to accept payment and transactions beyond physical cash.”

EQUITIES SHED N358BN AS NGX BEARISH STREAK CONTINUES

The Nigerian Exchange sustained its bearish momentum on Thursday as profit-taking and sell-offs in several large- and mid-cap stocks wiped out about N358bn from the market capitalisation. At the close of trading, the NGX’s market value fell to N91.9tn from the N92.26tn recorded in the previous session, reflecting the continued pressure from investors locking in recent gains. The All-Share Index dipped by 497.77 points, or 0.34 per cent, to close at 145,367.03 points. This brought the market’s one-week loss to 0.82 per cent, despite a four-week gain of 11.58 per cent and an impressive year-to-date growth of 41.23 per cent. Trading activity was upbeat compared to the previous session. Investors exchanged 2.46bn shares worth N22.22bn in 43,505 deals, representing an 83 per cent increase in volume, a 10 per cent rise in turnover, and a 42 per cent improvement in the number of deals. Market breadth remained negative, with 22 gainers against 52 losers. Juli led the gainers’ chart, rising by 10 per cent to close at N9.90 per share. Austin Laz & Company appreciated by 9.91 per cent to N2.33, NCR Nigeria climbed 9.43 per cent to N8.70, and Thomas Wyatt Nigeria gained 8.19 per cent to N3.70 per share. On the flip side, Wema Bank topped the losers’ table with a 10 per cent drop to N20.70 per share. C&I Leasing, UPDC, and Lasaco Assurance also shed 10 per cent each to close at N7.20, N7.20, and N4.50 per share, respectively. In terms of volume, Universal Insurance emerged as the most traded stock with 390.40m shares worth N577.44m, followed by Aiico Insurance with 236.57m shares valued at N1.11bn. Linkage Assurance traded 214.27m shares worth N589.19m, while Mutual Benefits Assurance exchanged 157.53m shares valued at N638.66m. On the value chart, Nigerian Breweries led with trades worth N1.87bn, followed by Ellah Lakes with N1.77bn, Access Holdings with N1.29bn, and Zenith Bank with N1.15bn.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026