FG TO REVOKE DORMANT OIL LICENCES WITH NEW POLICY

The Nigerian Upstream Petroleum Regulatory Commission has told oil producers that it is set to implement the ‘drill or drop’ policy. The Chief Executive of the NUPRC, Gbenga Komolafe, disclosed this when he received a delegation from the Independent Petroleum Producers Group at the commission’s headquarters in Abuja recently. According to a statement by the NUPRC, Komolafe emphasised that oil and gas producers must either begin production within a specified timeframe or relinquish their licenses. He stated that the policy aimed to revitalise the oil sector, ensure optimal use of assets, and boost government revenue. “Komolafe also discussed the implementation of the ‘drill or drop’ policy, which requires operators to either begin production within a specified timeframe or relinquish their licenses. This policy aims to revitalise the oil sector, ensure optimal use of assets, and boost government revenue,” the NUPRC chief executive was quoted. The PUNCH reports that the Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, had repeatedly vowed to enforce the ‘drill or drop’ policy would be implemented, saying the government would take over all idle oil wells from operators holding on to them. Meanwhile, at the meeting, Komolafe welcomed the delegation and reiterated the NUPRC’s dedication to creating an enabling business environment. He outlined several key policies implemented since the enactment of the Petroleum Industry Act, including the automation of regulatory processes such as granting of licenses and permits, which he said have significantly reduced bureaucratic delays and improved operational efficiency across the sector. The statement disclosed that the delegation was led by the IPPG Chairman, Mr Abdulrazaq Isa, who also serves as the Chairman of Waltersmith Group, an indigenous oil and gas company. “The visit was a strategic engagement aimed at strengthening collaboration between the commission and indigenous producers. It also served as an opportunity for the IPPG to formally express its appreciation to the NUPRC for the critical role it played in facilitating the recent divestment of assets by international oil companies. “These divestments, which were closely overseen by the commission, have enabled a significant transfer of upstream oil and gas assets to indigenous operators. This transition marks a pivotal shift in Nigeria’s energy landscape, creating new opportunities for local companies to scale up operations,” it was stated. During the meeting, the IPPG reportedly reaffirmed its commitment to supporting the commission’s ’Project One Million Barrels Incremental’ initiative—a programme designed to boost Nigeria’s daily crude oil production.

SEC DIRECTS FIRMS TO HONOUR UNCLAIMED DIVIDENDS

The Securities and Exchange Commission has directed all public companies and their registrars to stop treating unclaimed dividends older than 12 years as statute-barred, especially those declared before the enactment of the Finance Act 2020. The directive follows concerns that some companies and registrars continue to deny shareholders access to unclaimed dividends on the basis that they are over 12 years old, contrary to provisions of the Finance Act 2020. In a circular published by the Commission on Tuesday, the SEC reaffirmed that shareholders remain entitled to claim dividends that have not become statute-barred as of December 31, 2020, the date the Finance Act 2020 came into effect. “The attention of the Securities and Exchange Commission has been drawn to the fact that paying companies and their registrars have continued to treat unclaimed dividends of public companies that are older than 12 years as being ‘statute-barred’ without recourse to the provisions of the Finance Act 2020,” the circular read. Citing Section 60 of the Finance Act, the Commission noted that dividends unclaimed for six years or more are to be transferred to the Unclaimed Funds Trust Fund, where they are to be held in trust pending claims by rightful shareholders. The SEC added that until the Federal Government fully operationalises the UFTF, companies and registrars are expected to continue to honour shareholder requests for payment of such unclaimed dividends. “Pending the setting up and operationalisation of the UFTF by the Federal Government, pursuant to its powers under Sections 3 (4) (e) and 93 of the Investments and Securities Act 2025, the Commission hereby directs public companies and their registrars to continue to honour all requests by shareholders for the payment of unclaimed dividends as described above, with effect from December 31, 2020,” the Commission said.

INVESTORS HINGE SMES GROWTH ON POLICY SUPPORT

Stakeholders in the Nigerian impact investment ecosystem have highlighted the importance of policy support from the government to unlock capital for Micro, Small and Medium Enterprises. This was one of the outcomes of the deliberations at the High-Level Roundtable with policymakers and investors in Lagos on Monday. The roundtable was a pre-event of the 2025 Africa Impact Summit Study Tour to Nigeria, convened by the Impact Investors Foundation, Impact Investing Ghana, GSG Impact, Alitheia Capital, and Kuramo Capital, which emphasised the Nigerian government’s critical bridge role in unlocking capital for the approximately 40 million MSMEs operating in the country. Delivering remarks at the event, Dr Emeka Obi, the immediate past Permanent Secretary of the Federal Ministry of Budget and Economic Planning and current Permanent Secretary of the Ministry of Petroleum Resources, underscored the government’s commitment to fostering economic growth. “The vision of this study tour is a testament to Africa being a hub for sustainable development,” he said. Obi went on to commend the event organisers for arranging a “space where global investors, African entrepreneurs, and development institutions, as well as public sector leaders like us, can engage, exchange, and co-create.” Now, these conversations are not only timely, but they are necessary. “Nigeria is a resilient country. Nigeria is deeply blessed, and everything follows the leadership. That’s why we must have a good situation. We are not living in a place where there is manipulation. That’s why we need effective policy changes, and we need the policy implementation to affect not just us but even the coming generation.” The Fireside Chat featured an engaging conversation between two global voices in the impact investing movement, the Chief Executive Officer of GSG Impact, Ms. Elizabeth Boggs Davidsen, and the Chair of GSG Nigeria Partner and Vice Chair of GSG Impact, Mrs. Ibukun Awosika. Davidsen, sharing insights into her vision for her role, said, “My ambition is really to strengthen and enable this network, and that means building out new partners here in Africa and other places in the world, particularly in Asia as well. It means, how do we make sure that the network has what it needs to be effective, and that’s, in certain instances, trying to leverage resources to be able to have a strong independent secretariat, sort of navigating these new chapters. “We’re also trying to develop new policy tools and to advocate effectively with our policy tools. And then the third area that we’re quite focused on is a bit of a newer area for us, but it is to enable and catalyse investment vehicles. What can we do as a global organisation to shine a light on investment vehicles that are being originated here by the national chapters for all the right reasons in the global context? Our job is to help crowd in some capital for that, both to help stand up the structures and also to, of course, build out and to see additional investment capital coming into the structures.”

NAIRA TO STABILISE AT N1,600–N1,650/$ – REWANE

Economist and Managing Director of Financial Derivatives Limited, Bismarck Rewane, has projected that the naira would trade within N1,600-N1,650 to a dollar in the near term. Rewane said this during his presentation at the June edition of the Lagos Business School Breakfast session. The analysts who did a mid-term economic review of the current administration maintained that the Nigerian currency remains undervalued by 26.82 per cent, while the dollar, which has weakened by 8.7 per cent year-to-date, could support the strengthening of the naira. He said, “The official and parallel market rates have converged more closely. Now trading within a 1–3 per cent margin. A major improvement from the 50–70 per cent gap observed pre-reforms. The spread is now within the N50 margin, meaning that the naira is now fairly priced and the naira will trade at about N1,600-N1,650/$”. For the June/July period, Rewane projected that “inflation data will reveal a slight decline to 23.15 per cent. The real GDP growth for Q1 25 will come out at 3.4 per cent. Brent will trade at $60-$63 pb as OPEC+ increases output. Nigeria’s oil production will increase to 1.5 mbpd. The price of PMS will decline marginally to N845/litre. Diesel will trade at N950/litre. Corporate profitability in Q2’25 will increase as companies carry lower inventory. FAAC allocation will be flat at N1.6tn as corporate income tax clawback reduces tax liabilities.” He also projected that the Monetary Policy Committee of the Central Bank of Nigeria would drop the benchmark rate by 50bp at its next meeting. He added that Nigeria will be mostly unaffected by the tariffs imposed by US President Donald Trump in the global trade arena. Rewane’s projection on the naira was substantiated by analysts at Meristem, who estimated that it would remain relatively stable at the official window, supported by sustained FX interventions and improved market liquidity. “However, the parallel market is likely to remain under pressure, especially if downward risks to FX inflows persist and speculative demand stays elevated. As a result, the widening spread between both markets may linger in the near term,” he stated. In May, the naira appreciated marginally at the Nigerian Foreign Exchange Market, suggesting a relatively steady FX supply supported by the CBN’s sustained interventions. It, however, depreciated month-on-month at the parallel market, widening the spread between both markets to N24.25/$ in May from N1.69/$ in April. The Meristem monthly report noted that this was the first notable divergence since March 2025 and attributed the widening gap to sustained demand pressures and speculative activities amid growing uncertainties in the global market. On the corporate performance front, Rewane painted a positive picture, saying there was strong revenue and profit growth, reflecting robust business performance and higher domesticated debt which shields firms from naira devaluation risks tied to foreign loans. The private sector also has faster access to local funding, ideal for working capital and short-term needs, as seen in the volume of commercial papers being offered. This reliable domestic credit has supported expansion and bridge financing for corporate Nigeria.

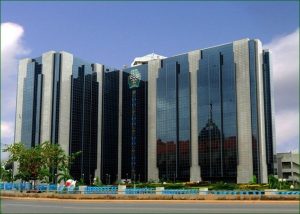

NO EXTENSION OF BDC RECAPITALISATION DEADLINE – CBN

The Central Bank of Nigeria has refuted claims in the media suggesting an extension of the deadline for the recapitalisation of Bureau De Change operators to December 31, 2025. In a statement on Wednesday, the CBN’s acting Director of the Corporate Communications Department, Mrs Hakama Sidi-Ali, dismissed the information as “false” and “misleading.” She reiterated that no such extension had been granted and that the official deadline remains set for June 3, 2025, as previously communicated. “The Central Bank of Nigeria has debunked a news story in circulation suggesting that the Bank has extended the deadline for the recapitalisation of Bureau De Change operators to December 31, 2025,” the statement read. It added, “The bank has not granted any such extension beyond the previously communicated deadline of June 3, 2025.” The CBN urged the public, media houses, and stakeholders to verify any information related to its policies through the bank’s official communication channels, including its website. The clarification comes as the CBN continues to enforce its new regulatory framework for BDCs, introduced in February 2024, which mandates BDC operators to meet higher capital requirements. Tier-1 operators are required to meet a capital requirement of N2bn, while Tier-2 operators must meet N500m. The CBN said that it remained committed to ensuring stability and transparency in Nigeria’s foreign exchange market, engaging with relevant stakeholders to ensure compliance with the regulatory framework. The PUNCH earlier reported that the Association of Bureau De Change Operators of Nigeria warned that about three million Nigerians were at risk of losing their source of livelihood if BDCs closed shop due to their inability to meet the new capital threshold.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026