NNPCL WEIGHS OVERHAUL, REPURPOSING OPTIONS FOR REFINERIES

The Nigerian National Petroleum Company Limited has said it is assessing the operational and commercial viability of its three major refineries in Port Harcourt, Warri, and Kaduna to determine whether to overhaul or repurpose them for enhanced efficiency and profitability. According to the company, the ongoing technical and commercial review is part of a broader plan to reposition the refineries as sustainable, revenue-generating assets that can meet Nigeria’s fuel demand and align with international operational standards. The company disclosed this on Wednesday through an official update shared via the verified X handle of its Group Chief Executive Officer, Bayo Ojulari (@BayoOjulari). It stated that the review marks the beginning of a new era in Nigeria’s refining sector. “We are filled with determination and looking ahead with optimism to ensure our refineries operate effectively. “Our drive is fuelled by the understanding that the prosperity of Nigerian states and the success of our nation will always take precedence over individual interests,” the post read in part.

NGX GROUP MARKET CAPITALISATION SOARS 37.7% TO N141.75T

The Nigerian Exchange Group has recorded a 37.7 per cent growth in market capitalisation, rising to N141.75tn as of September 2025 from N102.94tn in the same period of 2024. This performance reflects growing investor confidence and the Group’s continued focus on innovation, technology, and sustainability under the leadership of its Group Managing Director and Chief Executive Officer, Temi Popoola, who said the growth demonstrates that the strength of Nigeria’s capital markets cannot be separated from the strength of the communities they serve. “For us at NGX Group, building strong capital markets goes hand in hand with building strong communities, because inclusive growth and social well-being are the true foundations of a resilient economy,” he said. In line with this vision, NGX Group has deepened its commitment to social impact through its flagship initiative, Project BLOOM (Bringing Life to Our Overlooked Minors). The programme, implemented in partnership with the Lagos State Government and the Health Emergency Initiative, has reached over 200 children and 180 caregivers in underserved communities like Ajegunle and Yaba, providing therapeutic food, medical care, and nutrition education.

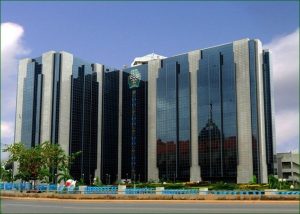

CBN URGED TO INTRODUCE N10,000, N20,000 SINGLE NOTES

A new economic review by Quartus Economics has urged the Central Bank of Nigeria to introduce higher-value currency notes such as N10,000 and N20,000 bills to restore the naira’s portability and reduce the rising cost of cash transactions.The report, titled “Is Africa’s Eagle Stuck or Soaring Back to Life?”, warned that the naira’s continued depreciation had rendered the N1,000 note, the country’s highest denomination, practically obsolete in terms of purchasing power. “To make the naira portable again, Nigeria can introduce higher-value bills, e.g., N10,000 or N20,000 notes, or redenominate the currency entirely,” the report stated. According to the analysts, a N5,000 note that would have been introduced in 2012 would now be equivalent to a single N50,000 note today, reflecting the 94 per cent decline in the naira’s real value over the last two decades. It added that the notion that introducing higher-value notes could worsen inflation was a “myth unsupported by evidence,” explaining that inflation is driven by cost-push and demand-pull factors, not by currency denomination. “Inflation is cost-push or demand-pull. Neither is related to currency denomination. Instead, countries introduce higher notes to maintain portability after an era of currency depreciation. “Countries introduce higher-value notes to maintain portability after a period of significant currency depreciation, not to trigger inflation,” the report clarified.

INVESTORS LOSE N371BN AS SELL PRESSURE HITS NGX

The Nigerian Exchange closed on a negative note on Thursday as sell pressure in key stocks dragged the benchmark index lower, leading to a loss of N371 billion in investors’ wealth. At the close of trading, the All-Share Index declined by 584.32 points or 0.38 per cent to settle at 153,676.66 points, while market capitalisation fell to N97.6 tn from N97.97 tn recorded in the previous session.Trading activity improved across major indicators as investors exchanged 495.85 million shares worth N29.56 bn in 28,926 deals. This represented a nine per cent rise in volume, a 99 per cent increase in value, and a five per cent growth in the number of deals compared to Wednesday’s session. Market breadth remained negative, with 40 losers against 20 gainers. Oando Plc led the gainers’ chart with a 9.99 per cent increase to close at N46.80 per share, followed by Aso Savings and Loans with a 9.3 per cent gain, AIICO Insurance with a 5.26 per cent gain, and May & Baker Nigeria with a five per cent increase.

NIGERIANS LOSE N316BN TO PONZI SCHEMES – SEC

The Securities and Exchange Commission has said Nigerians have lost about N316bn to Ponzi schemes and illegal fund managers over the years, warning that greed and ignorance are sustaining the menace. The Head of FinTech and Innovation Department at the Commission, AbdulRasheed Dan-Abu, disclosed this at a journalists’ academy, a training organised by the commission for finance journalists, in Abuja, while presenting a paper on combating investment fraud. He described Ponzi schemes as fraudulent investment operations that pay returns to old investors from money collected from new entrants rather than from any genuine business activity. “These schemes are not really doing anything. They are just collecting people’s money and using it to pay the initial investors. At some point, when there are no new investors, the whole thing crashes and the operators disappear,” he said.According to him, the desire for instant wealth has made many Nigerians fall victim. “Everybody just wants to get rich today. That is actually what makes people fall into this trap,’ he noted. ‘Even the people who are greedy now are more educated than those who experienced Charles Ponzi’s first scheme. Education has not stopped greed.”

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026