NIGERIA MISSED OPEC OIL QUOTA IN NINE MONTHS

Nigeria’s crude oil output dipped in December 2025 by 14,000 barrels per day, defying government efforts to ramp up production. According to data from the Nigerian Upstream Petroleum Regulatory Commission, instead of rising to meet the 1.5 million barrels per day quota set for Nigeria by the Organisation of the Petroleum Exporting Countries, crude oil production fell from 1.436 mbpd in November to 1.422 mbpd in December, representing 95 per cent of the OPEC quota. The data show that in 2025, Nigeria’s crude oil production fell below its OPEC quota in nine months of the year, meeting or slightly exceeding the target only in January, June, and July. A review of the average daily crude oil output indicates that Nigeria opened the year strongly, producing 1.54 mbpd in January, about 38,700 bpd above its OPEC allocation. Output, however, dipped below the quota in February at 1.47 mbpd and weakened further in March, when production averaged 1.40 mbpd, representing one of the widest shortfalls of the year.

INFLATION DROPS TO 15.15% AFTER NBS REVIEW

Nigeria’s headline inflation rate eased to 15.15 percent in December 2025 following a methodological review by the National Bureau of Statistics, marking a sharp moderation in price pressures compared with both the preceding month and the same period last year. The latest Consumer Price Index report released by the NBS showed that the CPI rose to 131.2 points in December 2025 from 130.5 points in November, indicating a slower pace of increase in average prices. On a year-on-year basis, inflation declined from 17.33 percent in November 2025 and was significantly lower than the 34.80 percent recorded in December 2024, showing a notable deceleration in headline inflation over the 12-month period. The report read, “The Consumer Price Index rose to 131.2 in December 2025, up by 0.7 points from the previous month (130.5). The December 2025 year-on-year headline inflation rate stood at 15.15 percent relative to the November 2025 headline inflation rate (17.33 percent).

EQUITIES MARKET REVERSES GAINS, SHEDS N457BN

The Nigerian stock market reversed gains from the previous session, recording a loss of N457 billion for investors on Thursday. The decline followed 23 consecutive bullish sessions. The downturn was driven by profit-taking in stocks such as McNicholas, Caverton Offshore Support Group, Ikeja Hotel, FTN Cocoa Processors, Neimeth International Pharmaceutical, and 36 other declining stocks. Specifically, the Nigerian Exchange Ltd. market capitalisation, which opened at N106.780 trillion, shed N457 billion, or 0.43 percent, to close at N106.323 trillion. The All-Share Index also lost 0.43 percent, or 714.66 points, to close at 166,057.29, against 166,771.95 recorded on Wednesday. Similarly, market breadth closed negative, with 41 losers against 36 gainers. McNicholas led the losers’ chart, dropping by 9.99 percent to settle at N6.58. Caverton Offshore Support Group followed with a decline of 9.47 percent to close at N7.65, while Ikeja Hotel lost 9.43 percent, ending the session at N35.05 per share.

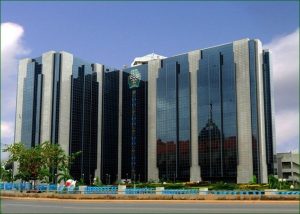

RECAPITALISATION: 20 BANKS HIT CAPITAL MARK AHEAD OF DEADLINE

The Central Bank of Nigeria has said that about 20 deposit money banks have already met the new capital requirements under the ongoing banking recapitalization program, as the apex bank shifts focus toward ensuring that stronger balance sheets translate into real sector credit growth. This was disclosed by the Deputy Governor, Economic Policy, Central Bank of Nigeria, Dr Muhammad Abdullahi, on Thursday while speaking on a panel at the launch of the 2026 Macroeconomic Outlook of the Nigerian Economic Summit Group in Lagos. The PUNCH had earlier reported that at the last Monetary Policy Committee meeting of 2025, the Governor of the Central Bank of Nigeria, Olayemi Cardoso, disclosed that 16 banks have achieved full compliance with the revised capital requirements, ahead of the deadline. According to Abdullahi, the recapitalization program was designed to build stronger banks capable of supporting Nigeria’s ambition of becoming a trillion-dollar economy.

CASH RUSH: ATM WITHDRAWALS JUMP 198% TO N36TN

Nigerians continued to lean heavily on cash withdrawals despite higher automated teller machine charges introduced by the Central Bank of Nigeria, as the value of ATM transactions jumped to N36.34tn in the first half of 2025, reinforcing the resilience of cash usage in the economy. Data from the CBN quarterly statistical bulletin show that ATM withdrawals between January and June 2025 amounted to N36.34tn, nearly tripling the N12.21tn recorded in the corresponding period of 2024. This represents an increase of N24.13tn, equivalent to a 197.66 percent year on year rise, even as regulators moved to discourage excessive cash usage through revised fees and tightening monetary policy. According to the data on the transaction volumes, Nigerians carried out 858.80 million ATM withdrawals in the first six months of 2025, compared with 496.47 million transactions in the

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026