NNPC DISAGREES AS REPORT PUTS PETROL DEBT AT $6BN

Nigeria’s debt to suppliers of Premium Motor Spirit, popularly called petrol, has surpassed $6bn, doubling what it was since early April, as the Nigerian National Petroleum Company Limited struggles to cover the gap between fixed pump prices and international fuel costs, six industry sources told Reuters. Although this was swiftly described as false by NNPC on Thursday, the Reuters report stated that the national oil company began struggling early this year when late PMS payments surpassed $3bn. The company has still not paid for some January imports, traders said, and the late payments amount to between $4bn and $5bn. Under contract terms, NNPC is meant to pay within 90 days of delivery. “The only reason traders are putting up with it is the $250,000 a month (per cargo) for late payment compensation,” one industry source said. At least two suppliers already stopped participating in recent tenders after hitting self-imposed debt exposure limits to Nigeria, the sources said, meaning they will not send more PMS until they receive payments. Traders thrive in risky environments, but they place limits on how much credit they allocate per trade in order to avoid too much exposure on one borrower. These limits vary by company based on their size and where they operate. As a result, Nigeria’s tenders to buy gasoline in June and July were smaller, traders said. NNPC will import via tender about 850,000 tonnes in July, two of the sources said, down from the typical one million tonnes in previous months. But when contacted by our correspondent and asked to react to the claims by traders as captured in the report, the spokesperson of NNPC, Olufemi Soneye described it as “false.” He went ahead to say, “False. Did they name the marketers they claim we supposedly owe? Let them name them.” President Bola Tinubu announced an end to expensive fuel subsidies in May last year, allowing pump prices to triple. But NNPC capped pump prices shortly afterward as citizens chafed under rising cost of living. The cap, coupled with a naira currency crash, allowed the subsidy to creep back, according to industry analysts, though NNPC has denied the return of PMS subsidy. Analysts, NGOs and even government officials have slammed the subsidy for years as wasteful and corrupt. But Nigerians, who get few government services, have long seen cheap fuel as their right, especially in the current cost-of-living crisis.

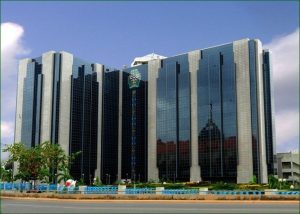

CBN TO SANCTION BANKS FOR REJECTING OLD, SMALL DOLLAR DENOMINATIONS

The Central Bank of Nigeria (CBN) has treathened to sanction Deposit Money Banks (DMBs) and Authorised foreign exchange dealers, for rejecting old and small denominations of the United States of America Dollar bills. In a circular issued by the Ag. Director of Currency Operations Department of CBN, Mr. Mohammed Solaja, with reference: COD/DIR/INT/CIR/001/017, the apex bank said its market intelligence had revealed the continued rejection of the affected Dollar notes, which it described as unacceptable. According to the CBN, its earlier circular number COD/DIR/INT/001//002, dated April 9, 2021, remained in force and that its provisions would be applied against any bank or authorised foreign exchange dealer who contravened the Guidelines. The, bank, in the new circular, dated June 27, 2024, which was seen by Vanguard, this afternoon, insisted that all parties must adhere to its directives. It said all DMBs and Authorised foreign exchange dealers must accept old series and small denominations of Dollars that are brought by their customers for deposit. It added, “The Central Bank of Nigeria will not hesitate to sanction any DMB or authorised foreign exchange dealer who refuses to accept old series/lower denominations of the US Dollar bills from their customers. “In addition, all authorised foreign exchange dealers are advised to desist from defacing/stamping US Banknotes as such notes always fail authentication test during processing/sorting.”

‘CBN DIRECTIVE ON FX DEPOSIT TO BOOST RESERVES’

Financial experts have said that the latest directive from the Central Bank of Nigeria asking banks to deposit their excess foreign exchange with it is aimed at boosting the country’s reserves. The pundits stated that in exclusive chats with The PUNCH on Sunday. The circular containing the new guidelines, which was signed by the Acting Director of the Currency Operations Department at the CBN, Solaja Mohammed, read in part, “In order to deepen the foreign exchange market, boost liquidity and attain convergence in the exchange rates of the parallel and official markets, the Central Bank of Nigeria has approved that DMBS may deposit their excess foreign currency notes with Lagos and Abuja branches of the Bank. The approval is a response to the increasing demand by DMBS to deposit their forex cash with CBN for onward credit to their off-shore accounts with the correspondent banks.” Reacting to the development, a former President of the Chartered Institute of Bankers of Nigeria, Okechukwu Unegbu, said, “The first one is to strengthen the reserves. There have been complaints about the depletion of foreign reserves. What they want to ensure is in a state where they can settle obligations, particularly, airlines that we are owing and servicing of our borrowings, which is very high. However, I doubt if it will be enough even if banks deposit their excess foreign exchange. “They will use it to boost the reserves, but I doubt if any bank will have excess because they also have to meet their customers’ demands for school fees, medicals and such. Despite the state of the market, people are still making demands. So I don’t know any bank that will be doing that.” According to an economic and capital market analyst, Rotimi Fakeyojo, from all indications, the banks would not be happy because they are taking away their free control over the deposits. “This implies that the CBN is finding a way to bring up new dimensions of oversight in that space such that when the deposit comes before you can take it out, there will be a process. We don’t know whether the process will be flawless for now.

BANKS RECAPITALIZATION WILL INCREASE LOANS, ADVANCES — PROSHARE

Analysts at Proshare Nigeria, an online news media, have projected increased bank loans and advances among other things following banks’ recapitalization. Presenting a book, “ Beyond Profit: How a Nigerian company built a culture of credibility”, in Lagos Mr. Teslim Shitta-Bey, Managing Editor/Chief Economist, Proshare Nigeria, said: “Banks will increase loans and advances. Those will result in increased manufacturing output, and our Gross Domestic Product, GDP, will grow faster. For those invested in the equity market, we expect that those companies will do better. There will be an increase in capital gain, and there will therefore be an increase in dividends, which, if households had invested in equity, there will be a higher household welfare.” Shitta-Bey noted that the recent Proshare BDSI report shows Access Bank, Zenith Bank, First Bank of Nigeria Holding, EcoBank, United Bank of Africa and Guaranty Trust Bank (FUGAZE), as the tier-1 banks with positions in the outlined order. Explaining the criteria of selecting the banks, he said: “Now, coming to the most recent BDSI report for 2024, we went even further than that and we decided to make those criteria 15 in number. “The Proshare report suggests that we have gone back to what we started off with in 2013 with Afrinvest. Afrinvest had an acronym for tier-1 banks, FUGAZE. “In 2024, Proshare discovered that the same FUGAZE are tier-1 banks. Now, if you look at the analysis here, you will find that Access Bank in our first report was number one. It was top tier-1 bank. In the previous report, because of the adjustment in the criteria, Access Bank came to number four. But in 2024, they came back to number one. Reviewing the book, Dr. Ruben Abati, Host, ‘The Morning Show’ on Arise TV, congratulated the Author, Tosin Adeoti and Founder Proshare Nigeria, Femi Awoyemi. He added:”This book is the nearly two decade story of Proshare from its humble beginnings and its emergence as a leading player in the financial space in Nigeria with a growing global reputation”.

EQUITY MARKET VALUE DIPS N178BN IN ONE WEEK

The Nigerian equity market lost N178bn last week. The All-Share Index and Market Capitalisation depreciated by 0.04 per cent to close the week at 100,022.03 and N56.581tn, respectively. The price appreciation of 37 stocks during the week was less than that of 48 stocks the week before. Also, 72 stocks stayed the same as they did the week before, while 45 stocks had a price decline compared to 34 stocks in the previous week. Last week, investors traded a total of 2.259 billion shares worth N31.166bn in 42,851 deals against the 2.651 billion shares worth N49.976bn in 41,610 deals transacted a week before. With 1.801 billion shares worth N22.030bn exchanged in 23,112 deals, the financial services industry led the activity chart as evaluated by volume. This industry contributed 70.69 per cent and 79.75 per cent of the total stock turnover value and volume, respectively. In 3,124 transactions, the oil and gas industry came in second with 121.001 million shares valued at N1.771bn. The conglomerate sector came third with 2,277 deals totaling 90.713 million shares valued at N1.081bn. Also, 909.821 million shares worth N12.057bn were traded in 4,798 deals involving the top three equities, Fidelity Bank Plc, Universal Insurance Plc, and Guaranty Trust Holding Company Plc (measured by volume). These deals accounted for 40.28 per cent and 38.69 per cent of the total equity turnover volume and value, respectively. Trading in the top three equities including, Fidelity Bank Plc, Universal Insurance Plc, and Guaranty Trust Holding Company Plc (measured by volume), accounted for 909.821 million shares worth N12.057bn in 4,798 deals, contributing 40.28 per cent and 38.69 per cent to the total equity turnover volume and value, respectively. All other indices finished higher with the exception of NGX 30, NGX Premium, NGX meristem Value, NGX Consumer Goods, NGX Lotus II, and NGX Pension Broad, which depreciated by 0.27 per cent, 0.52 per cent, 0.01 per cent, 0.69 per cent, 0.56 per cent, and 0.07 per cent, respectively, while the NGX Alternative Securities Market and NGX Sovereign Bond indices closed flat. Last week, Punch Online reported that investors in Nigeria’s equity market gained N475bn, buoyed by Computer Warehouse Group, FTN Cocoa Processors, and United Capital Plc.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026