NIGERIA’S OIL OUTPUT SOARS ABOVE OPEC QUOTA

Nigeria’s average daily crude production rose above the quota allocated to it by the Organisation of the Petroleum Exporting Countries in June 2025. For the second time in 2025, the country exceeded its OPEC quota of 1.5 million barrels per day. First in January and second in June. According to a report by the Nigerian Upstream Petroleum Regulatory Commission, the country’s average daily crude production was 1,505,474 barrels, representing 100.4 per cent of the OPEC quota. Oil production, including crude and condensate, was approximately 1.7 mbpd. This was an improvement in crude production when compared to the previous months. In May, crude output stood at 1.45mpd while both crude and condensate were 1.65mbpd. Production was as low as 1.60 in March. In its remark, the NUPRC said, “Lowest and peak combined crude oil and condensate production in June were 1.61 million bopd and 1.82 million bopd, respectively. “The average crude oil production was 100.4 per cent of the OPEC quota (1.5 mbpd). The daily average production in June was 1,697,045 barrels per day, comprising both Crude oil (1,505,474 bopd) and condensate (191,572 bopd).” However, the output was still below the targeted 2.06mbpd projected in the 2025 budget. Recently, the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited, Bayo Ojulari, said Nigeria was ramping up production with a medium-term goal to hit 2.06 million barrels per day by 2027. He expressed optimism that oil output would rise to 1.9mbpd in December this year. “We have started growing. In March, we were producing about 1.56 million barrels per day, and we’re now at 1.63 million, including condensates. By the end of the year, we are hoping to clock 1.9 million barrels daily,” he said. Ojulari said Nigeria had recorded a 100 per cent availability on major crude oil pipelines in the country. He noted that for the first time in a long while, the nation enjoyed 100 per cent crude oil pipeline availability throughout June. According to him, the feat, which was possible through the industry-wide security interventions led by the NNPC, aided the increase in oil production. However, he called for more investments to boost production, adding that the company had been able to turn the narrative around by consistently meeting its cash-call obligations to Joint Venture operations. With the current state of oil pipelines, experts expect a further rise in oil production in the coming months.

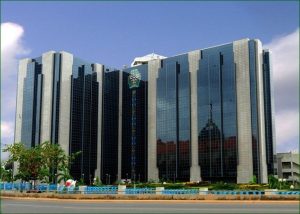

CBN INJECTS $4.1BN TO DEFEND NAIRA AS RESERVES DECLINE

The Central Bank of Nigeria injected a total of $4.1bn into the foreign exchange market in the first half of 2025, a move aimed at stabilising the naira and easing liquidity pressures in the currency market. This figure, which is more than three times the $1.3bn recorded during the same period in 2024, was contained in the latest CSL Stockbrokers’ H2 2025 Outlook report. According to an analysis of the data from the report, there was a 215% increase. CSL Stockbrokers Limited is a member of FCMB Group and also a member of the Nigerian Stock Exchange. This came as industry analysts expressed concerns over the sustainability of the currency defence strategy, citing weak oil earnings, subdued foreign portfolio investment inflows, and uncertainties around external financing. However, members of the Organised Private Sector argued that no responsible central bank would allow market forces to solely determine the value of its currency without some form of intervention to ensure stability. Also, The PUNCH observed that Nigeria’s gross external reserves fell by $3.67bn in the first half of 2025, based on data obtained from the Central Bank of Nigeria. According to the CSL Stockbrokers’ report, the CBN’s aggressive intervention reflects a stronger commitment to defending the naira amid persistent volatility and weak capital inflows. The naira, which opened the year at N1,535 to the US dollar in the official market, appreciated slightly to N1,530/$ by the end of June, supported largely by these FX injections. The report read, “The local currency, which opened the year at around N1,535/$ in the official market, posted a marginal appreciation to close the first half at around N1,530/$, reflecting a YTD gain of 0.4 per cent. This relative stability was largely underpinned by sizable interventions from the CBN, which we believe helped contain depreciation pressures, especially during periods of heightened volatility. “Notably, the apex bank injected about $4.1bn into the FX market in H1 2025, well above the $1.3bn provided during the same period last year, demonstrating a stronger commitment to supporting market liquidity.” CSL noted that the apex bank’s interventions were most pronounced in April, when the naira temporarily weakened to N1,630/$ following heightened investor risk aversion triggered by the announcement of new US trade tariffs. “It is worth highlighting that in April, when foreign currency inflows were limited and the exchange rate temporarily weakened to as high as N1,630/US$, amid investor risk aversion triggered by the announcement of US trade tariffs, net FX inflows from the CBN surged to the highest level so far this year,” the report stated. Despite the interventions, CSL expressed concerns over the sustainability of the currency defence strategy, citing weak oil earnings, subdued foreign portfolio investment inflows, and uncertainties around external financing. Oil exports, which accounted for roughly 86 per cent of Nigeria’s total exports in 2024, are projected to fall by 20 per cent year-on-year to $36.4bn in 2025 due to lower prices and production constraints. On the capital market front, the report highlighted that foreign participation in Nigeria’s equities market rose to 29 per cent as of May 2025, up from 20 per cent in the same period of 2024. However, foreign outflows continued to outpace inflows, indicating lingering investor caution. Looking ahead, CSL warned that FX inflows could remain under pressure in the second half of the year, thereby limiting the scope for further appreciation of the naira. The firm anticipates increased domestic borrowing by the government in the second half of the year to fill the gap, which could further strain public finances.

JUNE INFLATION RATE DIPS TO 22.22%, LOWEST THIS YEAR

The National Bureau of Statistics has reported that Nigeria’s headline inflation rate decreased for the third consecutive month to 22.22 per cent in June 2025, down from 22.97 per cent recorded in May 2025. It was 23.71 per cent in April 2025, down from 24.23 per cent in the prior month. According to the latest Consumer Price Index report released by the bureau on Wednesday, the year-on-year figure reflects a 0.75 percentage point decline from the previous month and a significant 11.97 percentage point drop when compared to June 2024, which recorded an inflation rate of 34.19 per cent. The decline in annual inflation is being recorded against the backdrop of a rebased index, with 2024 as the new base year. On a month-on-month basis, however, inflation rose slightly to 1.68 per cent in June, compared to 1.53 per cent in May, suggesting that while the pace of price increases is slowing on an annual basis, prices are still rising faster from one month to the next. The CPI rose from 121.4 in May to 123.4 in June, indicating persistent price pressures, especially in food, transport, and housing. The NBS report read, “The Consumer Price Index rose to 123.4 in June 2025, reflecting a 2.0-point increase from the preceding month (121.4). In June 2025, the Headline inflation rate eased to 22.22 per cent relative to the May 2025 headline inflation rate of 22.97 per cent. Looking at the movement, the June 2025 Headline inflation rate showed a decrease of 0.75 per cent compared to the May 2025 Headline inflation rate. “On a year-on-year basis, the Headline inflation rate was 11.97 per cent lower than the rate recorded in June 2024 (34.19 per cent). This shows that the Headline inflation rate (year-on-year basis) decreased in June 2025 compared to the same month in the preceding year (i.e., June 2024), though with a different base year, November 2009 = 100.” The food inflation rate stood at 21.97 per cent year-on-year in June, a sharp drop from 40.87 per cent recorded in June 2024. This significant fall is attributed largely to the base year effect. On a month-on-month basis, food inflation rose to 3.25 per cent in June, up from 2.19 per cent in May, driven by price increases in staples such as tomatoes, pepper, dried green peas, crayfish, shrimps, meat, plantain flour, and ground pepper. The average annual rate of food inflation for the twelve-month period ending June 2025 stood at 28.28 per cent, down by 7.02 percentage points from the 35.3 per cent recorded over a similar period last year. Core inflation, which excludes volatile items such as agricultural produce and energy, declined year-on-year to 22.76 per cent in June 2025 from 27.4 per cent in June 2024. On a month-on-month basis, however, core inflation increased to 2.46 per cent, up from 1.10 per cent in May, reflecting renewed pressures in non-food components. The average 12-month inflation rate for core items stood at 24.14 per cent in June 2025, slightly higher than the 24.01 per cent recorded in the corresponding period of 2024. The report showed a divergence in inflation trends between urban and rural areas. Urban inflation dropped to 22.72 per cent year-on-year in June from 36.55 per cent in June 2024, while rising to 2.11 per cent month-on-month, from 1.40 per cent in May. The 12-month average for urban inflation also declined to 28.16 per cent. Rural inflation followed a similar pattern, easing to 20.85 per cent year-on-year from 32.09 per cent, but slowing month-on-month to 0.63 per cent in June, from 1.83 per cent in May. The average annual rural inflation rate stood at 24.65 per cent. In terms of state-level data, Borno recorded the highest year-on-year all-items inflation rate at 31.63 per cent, followed by Abuja at 26.79 per cent and Benue at 25.91 per cent. The slowest increases were recorded in Zamfara at 9.90 per cent, Yobe at 13.51 per cent, and Sokoto at 15.78 per cent.

STOCK MARKET GAINS N1.44TRN TO CROSS N81TRN MARKET CAPITALISATION

The Nigerian stock market yesterday gained N1.44trillion to push the market capitlisation above the N81 trillion mark on investors demand for listed banking stocks. Notable buy pressure in key stocks like: Stanbic IBTC Holdings, Guaranty Trust Holding Company (GTCO), Zenith Bank Plc, United Bank for Africa Plc (UBA), Fidelity Bank Plc, Ecobank Transnatinal Incporoated (ETI) FCMB Group Plc, Dangote Cement Plc and MTN Nigeria Communications (MTNN) drove the market’s strong performance. On the gain in GTCO, and 40 others, the Nigerian Exchange Limited All-Share Index (NGX ASI) gained 2,277.54 basis points or 1.20 per cent to close at 128,967.08 basis points from 126,689.54 basis points it opened for trading Consequently, market capitalisation rose by N1.44 trillion to close at N81.585 trillion from N80.143 trillion it opened for trading. Despite the overall positive tone, market breadth was slightly negative, with 41 gainers trailing 44 decliners. Eunisell Interlinked, Nestle Nigeria, Omatek Ventures and Secure Electronic Technology emerged the highest price gainer of 10 per cent each to close at N14.85, N1,650.00, N1.76 and N1.21 respectively, per share. Tripple Gee and Company increased rose by 9.92 per cent to close at N4.32, while First HoldCo appreciated by 9.90 per cent to close at N32.20, per share. On the other side, FTN Cocoa processors and NPF Microfinance Bank led others on the losers’ chart with 10 per cent each to close at N7.02 and N2.43 respectively, while C&I Leasing followed with a decline of 9.97 per cent to close at N7.13, per share. Champion Breweries down by 9.96 per cent to close at N12.29, while Academy Press depreciated by 9.95 per cent to close at N8.33, per share. The total volume traded advanced 807.03 per cent to 11.671 billion units, valued at N363.412 billion, and exchanged in 36,635 deals. Transactions in the shares of First HoldCo led the activity with 10.467 billion shares worth N324.473 billion. United Bank for Africa (UBA) followed with account of 157.540 million shares valued at N7.623 billion, while Access Holdings traded 124.641 million shares valued at N3.265 billion. Universal Insurance traded 124.079 million shares worth N89.988 million, while Zenith Bank traded 66.280 million shares worth N5.085 billion. On market outlook, Afrinvest Limited said, “we expect the bourse to sustain the upbeat momentum as investors continue to engage in strategic positioning.”

LCCI FORECASTS INFLATION DROP, INTEREST RATES CUTS

The Lagos Chamber of Commerce and Industry has expressed optimism about Nigeria’s economic outlook in the second half of 2025, forecasting a gradual reduction in inflation and potential monetary policy easing, provided current reforms are sustained. Chairman of the LCCI Economic and Statistics Committee, Dr. Biodun Adedipe, delivered the Chamber’s forecast during its Mid-Year Economic Outlook and Review Conference held in Lagos on Wednesday, noting its optimism and backing expectations of improved macroeconomic indicators going forward. Adedipe observed that headline inflation had begun a downward trend, dropping from 23.71 per cent in April to 22.97 per cent in May 2025. He predicted that inflation would ease further in the coming months as reforms deepen and supply-side shocks are managed more effectively. “The signals from the monetary and fiscal space are clear,” Adedipe stated. “We are expecting a sustained drop in inflation through the second half of the year. This will provide room for the CBN to ease the Monetary Policy Rate, which currently stands at 27.5 per cent.” The National Bureau of Statistics reported on Wednesday that the inflation rate dropped to 22.22 per cent, marking the third consecutive easing of inflation. He also cited improvements in external reserves, now at 8.38 months of import cover, and increased oil production as key stabilising factors for the economy. He said, “We’ve seen encouraging signs with our foreign reserves climbing and oil production reaching 1.68 million barrels per day. The stock market has also gained 22.28 per cent year-to-date, which reflects growing investor confidence.” Adedipe, who is also the Founder and Chief Consultant of BAA Consult, pointed to the impressive performance of non-oil exports, which rose to $1.791bn in Q1 2025, a 24.75 per cent increase over the same period in 2024. “These numbers underscore the importance of building a more diversified and resilient export base,” he added. Despite the positive forecast, the economist stressed that structural challenges continue to impede inclusive growth: “High energy costs, infrastructure gaps, erratic power supply, and security issues remain major drags on the real sector, especially for Small and Medium-sized Enterprises.” He emphasised that the New Nigeria Tax Act has made progress in widening the tax base and improving compliance via digital platforms. However, more coordinated actions are needed across monetary and fiscal institutions to ensure lasting macroeconomic stability. On policy recommendations, Adedipe urged the government to enforce disciplined fiscal operations, reduce the informal sector’s share of Gross Domestic Product through long-term planning, and leverage over 22,000 cooperatives nationwide to deliver targeted interventions. He also identified critical sectors ripe for investment, including agriculture, real estate, fintech, education, and recycling, stating: “From cassava and poultry farming to mobile money and waste management, the opportunities are enormous.” Meanwhile, the president of the LCCI, Gabriel Idahosa, said Nigeria has an opportunity to consolidate on modest gains recorded in the first half of the year. “We recorded modest GDP growth in the first two quarters of 2025, mainly driven by services, telecommunications, and some recovery in oil production. However, headline inflation remains at uncomfortable double-digit levels, eroding purchasing power and raising business costs,” Idahosa remarked. He noted that despite tighter monetary policies and interest rate hikes by the Central Bank of Nigeria, inflation has proven stubborn due to high food prices, energy costs, currency depreciation, and persistent logistics disruptions. Idahosa said, “Inflationary pressures are still elevated. This poses a major challenge to private investment and household consumption. We must urgently address macroeconomic imbalances, particularly foreign exchange illiquidity and speculative tendencies, which are still denting investor confidence.” Despite these concerns, the LCCI chief acknowledged the resilience and innovation within Nigeria’s economy, citing progress in the technology sector, fintech, and creative industries as indicators of the country’s economic potential. Idahosa echoed the call for increased collaboration between public and private actors, saying, “Regulatory agencies must avoid abrupt decisions that raise the cost of doing business. We need legal clarity, transparent governance, and predictable policies to sustain investor confidence.” He added that the government must act as a facilitator rather than a competitor in the business environment, saying, “The LCCI remains committed to supporting government policy with data, feedback, and engagement. We will continue to advocate for reforms that improve competitiveness, protect investments, and create jobs.”

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026