NIGERIA’S PETROL IMPORTS SURGED IN OCTOBER – OPEC

The volume of Premium Motor Spirit (petrol) imported into Nigeria surged in October, a report by the Organisation of the Petroleum Exporting Company says. This is despite the fact that the Dangote Petroleum Refinery started producing petrol in September this year. OPEC, in its Monthly Oil Market Report, said though petrol import still remains at a 60 per cent low when compared to the same period in 2023, there was an increase in the quantity of PMS imported between September and October 2024. Recall that some vessels arrived on the shores of Nigeria to discharge PMS, especially at a time when marketers were at loggerheads with the Dangote refinery. It was learned that petrol import into Nigeria and West Africa came majorly from Europe during the month under review. Quoting Argus, OPEC said, “Gasoline exports to West Africa strengthened and compensated for a drop in flows to the US. Exports to Nigeria were reported to have surged compared to the level registered in September despite still remaining 60 per cent lower, year-on-year.” The report disclosed that PMS crack spread in Rotterdam against Brent increased as PMS exports from Europe rose in October. Additional European PMS volumes were said to have been shipped to Libya and Saudi Arabia in October as well. The international organisation maintained that new product volumes entering international markets from Nigeria’s Dangote refinery, China’s Yulong petrochemical, and Mexico’s Olmeca refinery “are set to lengthen product balances going forward, particularly for gasoline.” Reuters earlier reports that about a third of Europe’s 1.33 million barrels per day average petrol exports in 2023 went to West Africa, a bigger chunk than any other region, with most of those exports ending up in Nigeria. It noted that the 650,000-capacity Dangote refinery could end a decades-long petrol trade from Europe to Africa, worth $17bn a year. Reuters, quoting analysts and traders, said the Dangote refinery was heaping pressure on European refineries already at risk of closure from heightened competition, adding that the refinery would be the largest in Africa and Europe when it reaches full capacity. The PUNCH observes that the Dangote refinery is gradually achieving its mission to end oil imports into Nigeria. “The gasoline crack spread against Brent averaged $17.34/b, which was $2.13 higher, month-on-month but $14.55 lower, y-o-y. “In October, the jet/kerosene crack spread in Rotterdam against Brent recovered the previous month’s losses, backed by favourable supply-side dynamics. According to Platts, jet fuel inventories as of October 31 showed a monthly decline, likely caused by reduced refinery runs and lower jet/kerosene output..

STOCK MARKET POSTS N83BN GAIN ON POSITIVE TRADING

The Nigerian Exchange Limited closed in the green zone on Monday, with N83bn added to the wealth of investors. This marked the third consecutive positive trading session in a market that had been marked by sell-offs and portfolio rebalancing activities. At the end of the past week, the NGX All-Share Index reflected a one-week decline of 0.20 per cent and a four-week decline of 0.38 per cent, with an overall year-to-date gain of 30.04 per cent. At the close of the day’s trading, the ASI of the local bourse increased 0.14 per cent to 97,373.94 points. The market capitalisation also rose by a similar percentage to settle at N59tn. The year-to-date return now stands at 30.23 per cent. Sectoral performance was mixed: the banking, consumer goods, and industrial sectors declined by 0.81 per cent, 0.10 per cent, and 0.03 per cent, respectively, while the insurance and oil/gas sectors rose by 0.23 per cent and 0.16 per cent. In total, 24 stocks advanced while 27 declined. The top gainers include Eunisell Interlinked which gained 10 per cent to close at N9.02, Aradel, which rose by 9.99 per cent to N533.80, JohnHolt shares appreciated by 9.98 per cent to N5.29, DeapCap gained 9.35 per cent to close at N1.17 and Custodian shares gained 8.62 per cent to close at N12.60 each. On the losers chart were United Capital whose shares shed 9.78 per cent of their value to settle at N16.15, Sovereign Insurance lost 7.25 per cent to close trading at N0.64, Prestige Assurance dipped by 6.67 per cent to N0.56, Consolidated Hallmark Plc lost 5.88 per cent of its share value to close at N1.60 and Tripple G shed 5.49 per cent to close at N1.72. Trading activity was generally subdued, with volumes and values dropping by 37.82 per cent and 20.21 per cent, respectively, though the number of trading deals increased by 9.84 per cent. A total of 297.83 million shares were traded across 9,902 transactions, amounting to N7.52bn. Sterling Financial Holding Company Plc led in volume, with 36.1 million shares worth N180.9m across 168 trades, followed by the shares of United Bank for Africa, with 33,496,744 worth N1.041bn traded in 876 deals, About 24,595,015 units of AccessCorp shares valued at N590.09m were traded in 614 exchanges. 15,034,311 units of the shares of FlourMill worth N977.29m were traded in 61 deals and FBN Holdings, whose N150bn rights issue is still open, had 14,523,272 units of its shares worth N398.27m traded in 273 deals.

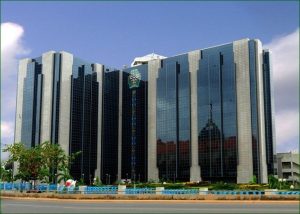

CBN LAUNCHES INITIATIVES TO DRIVE FINANCIAL INCLUSION

The Central Bank of Nigeria has officially launched three initiatives to drive financial inclusion in the country. The initiatives were launched at the second edition of the International Financial Inclusion Conference, which was held in Lagos on Tuesday under the theme, ‘Inclusive Growth: Harnessing Inclusion for Economic Development’. Speakers at the event highlighted the fact that women, and youths including small and medium enterprises were the most financially excluded categories of people in Nigeria. The IFIC is Nigeria’s leading financial Inclusion event hosted by the National Financial Inclusion Governance Committees. It is an engagement platform for regulatory institutions, financial services providers, development partners, and other financial inclusion ecosystem players and stakeholders to foster dialogue around contemporary developments, identify challenges to achieving financial inclusion goals, and propose solutions to ensure a more inclusive financial system. The initiatives unveiled during this year’s conference include the Women Financial Inclusion Dashboard which allows regulators and policymakers to identify and prioritise gender gaps in financial services; the Women Entrepreneurs Finance Code, which is a platform designed to transform the financing landscape for women-owned Micro, Small, and Medium Enterprises globally. The other is the Roadmap for the financial inclusion of Forcibly Displaced Persons, which is aimed at mobilising the collaborative efforts of financial institutions, regulatory bodies, government agencies, and non-governmental organisations to support FDPs in overcoming financial barriers, accessing essential services and establishing the foundation for their economic independence. Speaking at the conference, the Governor of the Central Bank of Nigeria, Olayemi Cardoso, said that the new capital requirement for banks operating in the country would boost their ability to drive financial inclusion. He said, “In line with its efforts to deepen financial inclusion, the Central Bank of Nigeria recently introduced new minimum capital requirements for banks. This strategic move ensures that banks are well-capitalised, enabling them to take on greater risk, particularly in underserved markets. With a stronger capital base, banks can provide more loans and financial products to MSMEs, rural communities, and other vulnerable segments that have previously struggled to access former financial services. “This policy not only strengthens financial stability but also serves as a catalyst for inclusive growth. By enabling banks to extend more credit to MSMEs, we enhance job creation and productivity. Furthermore, with increased capital, banks can invest in technology and innovation crucial for driving digital financial services such as mobile money and agent banking.” Highlighting some of the areas in which the World Bank is partnering with Nigeria to drive financial inclusion, the World Bank Country Director for Nigeria, Dr Ndiame Diop, said, “Three areas that the World Bank is partnering with CBN is to help address some of the constraints that stop people from full participation in the financial sector.

INVESTMENT & SECURITIES: DON’T CREATE FRICTION BETWEEN US AND SEC, CBN TELLS SENATE

The Central Bank of Nigeria (CBN) has urged the Senate to avoid creating unnecessary friction and crises between the bank and the Securities and Exchange Commission (SEC) over the proposed Investment and Securities Bill, 2024. During a public hearing on the bill, held on Thursday in Abuja and led by Senator Osita Izunaso (APC, Imo West), Chairman of the Senate Committee on Capital Market, CBN representative Dr. Tukur Galadima expressed concerns about the proposed bill granting absolute powers to SEC over public companies, particularly those under the regulation of the CBN. The bill aims to repeal the Investment and Securities Act 2007 and enact a new Investment and Securities Bill, 2024. Dr. Galadima criticized provisions in the bill, particularly those regarding the use of cash to purchase securities, calling it a violation of anti-money laundering laws. He also opposed the section allowing for investments in multi-currency, stating that the issue of currency is strictly within the purview of the CBN. He recommended that this provision be removed from the bill. Despite these concerns, Galadima emphasized that the CBN, along with other key stakeholders, supports the overall goal of the bill to regulate Nigeria’s investment and securities sector and strengthen the capital market. In his presentation, Dr. Emomotimi Agama, Director-General of SEC, welcomed the Senate committee’s efforts to repeal the 2007 Act, stating that the proposed law would be crucial for positioning Nigeria’s capital market among the world’s top players. He added that the law, if passed, would bring significant economic benefits, particularly in areas like the commodity market and cryptocurrency. Other stakeholders, including PENCOM, the Nigeria Deposit Insurance Corporation (NDIC), the Chartered Institute of Stockbrokers, the Capital Market Solicitors Association, and the Institute of Capital Market Registrars, also expressed support for the bill. Closing the session, Senator Izunaso acknowledged the sensitivity of the bill, noting that it covers the entire capital market as the primary ombudsman law. He assured stakeholders that the final draft of the bill would be ready by next week and urged the Accountant-General of the Federation’s office to engage with the committee to prevent any potential delays or rejections once the bill reaches the third reading in both chambers of the National Assembly.

FX CRISIS HALTS SMES’ EXPANSION, OPERATORS LAMENT

Operators of Small and Medium Enterprises say that the goal of expanding their businesses is becoming less feasible due to the hostile economic environment, especially the foreign exchange crisis, which is hitting import-reliant industries particularly hard. Business expansion dreams look less likely for industry players as Nigeria’s Gross Domestic Product which grew by 3.19 per cent in the second quarter of 2024, up from 2.51 per cent in Q2 2023, still suffers from the risk of inflation. According to the National Bureau of Statistics, inflation has surged to 32.70 per cent and compounded with naira devaluation and high borrowing costs, small businesses which make for more than 80 per cent of the labour force are stuck without expansion in sight. The National Vice President of the National Association of Small-Scale Industrialists, Segun Kuti-George, in a conversation with The PUNCH, highlighted how increasing input costs have driven many businesses to the brink of closure. “The economic situation is currently hostile to businesses because the cost of input is going up every day,” Kuti-George said. “A lot of businesses are closing shop. The first thing we should be looking at is survival.” He noted that businesses can survive and potentially expand by embracing innovation and diversification. According to the NASSI Vice President, “For any business to continue to exist and expand under the current situation, it has to be innovative,” citing Samsung’s evolution from tomato farming to electronics manufacturing as an example of successful diversification. He stressed that businesses could explore new products in related or entirely different areas to create alternative revenue streams. Industries with expansion potential, Kuti-George said, include agriculture, agro-processing, and technology. For instance, a beverage producer might diversify into water production, using existing resources to minimise additional costs. “You just look for products that won’t require so much investment for you to be able to produce,” he explained. Kuti-George also advised businesses to consider exporting, particularly under the African Continental Free Trade Area, as Africa presents growth opportunities with demand for Nigerian products.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026