NNPC, CHEVRON COMPLETE ASSETS CONVERSION, EYE 165,000BPD OIL PRODUCTION

The Nigerian National Petroleum Company Limited and its joint venture partner, Chevron Nigeria Ltd, have completed the conversion of five joint venture assets in compliance with the Petroleum Industry Act of 2021. The Chief Upstream Investment Officer at NNPC, Mr Bala Wunti, said the asset conversion is expected to significantly boost crude oil production, with the two companies targeting 165,000 barrels of oil per day by the end of 2024. He emphasised the importance of Chevron’s operational approach in maintaining network stability and ensuring a steady supply of gas to the domestic market. This transition follows the shift from the Petroleum Profit Tax regime to the more investor-friendly PIA terms. In a statement released by NNPC’s Chief Corporate Communications Officer, Olufemi Soneye, the company said both partners signed the necessary documents during a ceremony on Monday. The agreement converted five Oil Mining Leases into four Petroleum Prospecting Licenses and 26 Petroleum Mining Leases. This conversion represents a key milestone in increasing domestic gas supply and expanding Nigeria’s footprint in the global market. According to PIA provisions, all existing Oil Prospecting Licenses and OMLs will automatically transition into PPLs and PMLs upon expiration. However, companies also have the option to voluntarily convert under the PIA terms.

EQUITY MARKET RECOVERS WITH N178BN GAIN

The Nigerian equity market continued its seesaw movement on Thursday, as it rebounded from the previous day’s loss with a N178bn gain. The recovery was propelled by appreciation by FBN Holdings and Flour Mills Nigeria. The All-share index and market capitalisation were up by 0.32 per cent to 97,025.17 and N55.8tn, respectively. A total of 390,546,861 shares worth N7.97bn were traded in 9,615 deals, representing a 35 per cent decline in trading volume and a 9 per cent drop in turnover compared to the previous trading day. 1.5M 334 Family Accuses Firm Of Neglecting 22-year-old Factory Worker After Losing Arm At Workplace | Punch FBN Holdings and Caverton Offshore Support Group led 25 other gainers, appreciating by 10 per cent, followed by Flour Mills Nigeria and RT Briscoe, which rose by 9.99 per cent and 9.93 per cent, respectively. On the flip side, Daar Communications topped 21 other laggards, with an 8.86 per cent drop, closing at N0.72 per share. It was followed by Eterna (-8.14 per cent), Universal Insurance Company (-7.69 per cent), and Sovereign Trust Insurance (-5.97 per cent). Access Holdings led in trading volume with 80 million shares, followed by FBN Holdings with 52 million shares, United Bank for Africa with 31.1 million shares, and Caverton Offshore Support Group with 23.7 million shares. Performance across sectors was bullish, with three indices gaining, two declining, and the industrial goods index remaining unchanged.

NAIRA SURGED BY 4.8% AFTER DOMESTIC DOLLAR BOND SALE

The value of the naira recorded its highest gain by 4.8 per cent against the US dollar in nearly two months after the sale of the country’s debut domestic dollar bond. This marked the biggest jump since July 22. The currency closed at 1,558 naira per dollar on Wednesday, its strongest level against the greenback since August 21, Bloomberg reports. “Nigeria’s naira gained the most in almost two months after the West African nation announced that its debut domestic dollar-bond issue attracted significant demand. “The unit surged 4.8% against the dollar on Wednesday, the biggest increase since July 22, according to data compiled by Bloomberg. The currency closed at 1,558 naira per dollar, its strongest levelm against the greenback since Aug. 21.” The appreciation in the naira came after Nigeria’s first-ever foreign-currency domestic bond secured $900m in subscriptions. PUNCH Online reports that the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, stated that the $500m domestic FGN US Dollar Bond, which has a five-year maturity and a 9.75 per cent coupon, is the first tranche of a $2bn bond programme registered with the Securities and Exchange Commission. The bond’s structure allows the government to absorb oversubscriptions up to the full $2bn programme limit. He further explained that proceeds from the bond will be directed towards critical sectors of the economy, as approved by President Bola Ahmed Tinubu. The debut bond issuance attracted a broad spectrum of investors, including both local and diaspora Nigerians, as well as institutional investors.

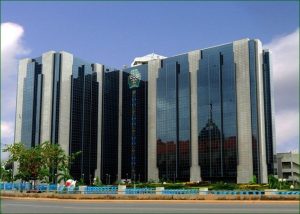

BANKS BORROWED N3TN FROM CBN IN ONE WEEK

Nigerian banks and discount houses borrowed N3tn from the Central Bank of Nigeria through the Standing Lending Facility within a week, according to a report by Afrinvest Research. The lenders and discount houses, however, deposited N493.6bn through the Standing Deposit Facility within the same period. According to the report, the spike in borrowing resulted in a 4.7 per cent increase in system liquidity, which now stands at N712.3bn. The Standing Lending Facility and Standing Deposit Facility are tools used by the Central Bank to manage money supply and liquidity in the financial system. The central bank issued a new directive to boost lending to the real sector, which took effect in April, signaling a shift towards a contractionary monetary policy approach. Recently, the Central Bank lifted the suspension on the Standing Lending Facility for authorised dealers, following a Monetary Policy Committee decision to adjust the upper corridor of the standing facilities to five per cent from one per cent around the Monetary Policy Rate. Afrinvest added that the surge in borrowing reflected the increased demand for short-term liquidity by banks and discount houses. However, despite the liquidity boost, inter-bank lending rates displayed mixed results, with the Open Purchase Rate decreasing by five basis points to 31.2 per cent, while the Overnight Rate edged up by three basis points to 31.7 per cent. In response to rising liquidity, the Debt Management Office reduced interest rates last week to create favourable borrowing conditions. Additionally, Afrinvest Research reported the successful launch of Nigeria’s first dollar-denominated bond, aimed at raising $500m to address the 2024 fiscal deficit. The bond, with a five-year maturity, was oversubscribed by $400m, signalling strong investor demand.

CBN MAY HALT INTEREST RATE HIKE

Nigeria’s annual inflation rate fell to a six-month low in August, offering the Central Bank of Nigeria a window to halt an unprecedented tightening cycle when they meet next week, according to Bloomberg. Consumer prices rose 32.2 per cent from 33.4 per cent in July, the National Bureau of Statistics said in a statement published on its website on Monday. That matched the median estimate of nine economists in a Bloomberg survey. The receding impact on prices of currency devaluation and the temporary removal of fuel subsidies instituted a year ago contributed to the slowdown. The measures formed part of reforms introduced by President Bola Tinubu after he entered office in May 2023 to attract investors, float the currency, and ease budget pressures. Higher corn yields and a six-month window to import the crop and wheat duty-free also contributed to the softening in price increases. Data collection was concluded before mid-August, so the effect of a 45 per cent increase in gasoline prices in early September, which saw a bump in transport costs, was not captured. The slowdown raises the prospect that policymakers will pause a tightening cycle that’s lifted the benchmark rate to 26.75 per cent from 11.5 per cent in just over two years. It will also give the monetary policy committee, which will announce its decision on Sept. 24, time to assess the impact of recent currency volatility, devastating floods in northeastern Nigeria and the increase in gasoline prices on inflation. Food inflation slowed to 37.5 per cent in August from 39.5 per cent a month earlier. Core price growth, which excludes agricultural produce and energy, quickened to 27.6 per cent from 27.5 per cent.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026