OIL IMPORTS CRASHED BY 35% IN Q2 – CBN

Nigeria’s oil imports dropped by 35 per cent in the second quarter of 2024, amounting to $2.79bn, down from $4.31bn in the previous quarter. This is according to the quarterly economic report of the Central Bank of Nigeria for the second quarter of 2024. This reduction highlights shifting dynamics in the nation’s oil and gas sector amid ongoing structural and economic adjustments following the removal of fuel subsidies under the administration of Bola Tinubu. The report also noted that the overall value of merchandise imports also contracted, falling by 20.59 per cent to $8.64bn from $10.88bn recorded in Q1 2024. The sharp decline in oil imports contributed significantly to this trend. The report read, “Merchandise import decreased in Q22024, following the decline in the import of petroleum products. Merchandise imports decreased by 20.59 per cent to $8.64bn, from $10.88bn in Q12024. “Analysis by composition indicated that oil imports decreased to $2.79bn, from $4.31bn in the preceding quarter. “Non-oil imports also declined to $5.85bn, from $6.57bn in the previous quarter. A breakdown of total import showed that non-oil imports accounted for 67.72 per cent, while oil imports constituted the balance.” The report further noted the pressures on domestic production, which fell by 4.51 per cent to 1.27m barrels per day. Persistent challenges such as oil theft and vandalism in the Niger Delta remain major impediments to production stability. The report read, “Domestic crude oil production declined in Q22024, attributed to persistent oil theft and illegal refining activities in the NigerDelta region. Nigeria’s average crude oil production fell by 4.51 per cent to 1.27 mbpd in Q22024, from 1.33 mbpd in the preceding quarter. “This was due to crude oil theft and pipeline vandalism in the Niger Delta region, leading to a decline in production from the Forcados, Bonny, Qua-Iboe, Escravos and Brass streams, respectively. Nigeria’s crude oil production level fell short of its OPEC quota of 1.58 mbpd by 308,000 bpd in Q22024.” Despite these setbacks, global crude oil prices provided a slight reprieve. Nigeria’s benchmark crude, Bonny Light, saw its price rise to $86.97 per barrel in Q2 2024, offering some relief to export revenues. Crude oil and gas exports accounted for 87.38 per cent of total export earnings during the quarter, although receipts fell marginally to $12.18bn from $12.42bn in Q1

STOCK MARKET POSTS N1.2TN LOSS AS INVESTORS SELL SHARES

Sell-offs in the stock market in the past week led to five days of consecutive losses for investors. At the end of the week, investors saw about N1.22tn shaved off their wealth. Analysts pinned the sell-offs in the market on portfolio balancing activities of investors who offloaded some shares like newcomer, Aradel which dipped by 25.75 per cent week-on-week, and BUA Cement whose value dipped by 11.09 per cent compared to the previous week. Also, researchers at Cowry Assets Management Limited blamed the negative trading pattern on cautious trading behaviour as investors grappled with economic uncertainties. They also attributed it to the latest macroeconomic data releases such as the data on internally generated revenue across its 36 states and the Federal Capital Territory for 2023 released by the National Bureau of Statistics. To close the week, the All-Share Index took a sharp 2.03 per cent week-on-week haircut, closing at 97,432.02 points. The market capitalisation dropped by 2.03 per cent week-on-week to settle at N59.04tn, wiping out N1.22tn in gains from prior weeks. As a result, the year-to-date return of the index settled at 30.30 per cent. In terms of trading activities, a total turnover of 2.717 billion shares worth N54.632bn were traded in 46,848 deals compared to 2.142 billion shares valued at N85.946bn that exchanged hands last week in 41,217 deals. The Financial Services Industry (measured by volume) led the activity chart with 1.821 billion shares valued at N28.958bn traded in 20,173 deals; thus contributing 67.01 per cent and 53.01 per cent to the total equity turnover volume and value, respectively. The ICT Industry followed with 389.848 million shares worth N6.560bn in 2,515 deals. Third place was the Conglomerates Industry, with a turnover of 160.993 million shares worth N4.746bn in 3,623 deals. The top three equities measured by volume include Fidelity Bank Plc, Chams Holding Company Plc and United Bank for Africa Plc which accounted for 1.225 billion shares worth N17.721bn exchanged in 4,912 deals, contributing 45.10 per cent and 32.44 per cent to the total equity turnover volume and value, respectively.

NIGERIANS REPAID N4.05TN PERSONAL LOANS IN Q2 – CBN

Nigerians repaid N4.05tn in personal loans during the second quarter of 2024, according to findings. In the latest quarterly economic report of the Central Bank of Nigeria, The PUNCH observed that this repayment reduced personal loan balances from N7.52tn in the first quarter to N3.47tn in the second quarter, marking a 53.9 per cent decrease. This trend coincides with the CBN’s monetary policy adjustments aimed at curbing inflation and controlling money supply. The PUNCH observed that Nigerians took about N5.49tn as personal loans from banks and other financial institutions in the first six months of this year. It means that Nigerians have repaid about 74 per cent of the fresh personal loans taken in Q1 2024 as the CBN hiked interest rates. The increased interest rates have made borrowing more expensive, prompting consumers to focus on repaying existing debts rather than incurring new ones. This is reflected in the overall decline of consumer credit outstanding by 42.6 per cent to N4.73tn in the second quarter. Personal loans accounted for 73.35 per cent of total consumer credit, while retail loans increased from N0.72tn to N1.26tn, indicating a shift towards smaller-scale credit facilities. This further means that while individuals are paying off their debts, small businesses in the retail sector are forced to borrow more to survive the high cost of doing business in the country. The CBN report read, “Consumer credit outstanding declined by 42.60 per cent to N4.73tn in Q22024, relative to the level in the preceding quarter. Personal loans fell to N3.47tn, from N7.52tn in Q12024, but remained dominant accounting for 73.35 per cent of the total consumer credit. Retail loans, however, grew to N1.26tn from N0.72tn in the preceding period.” The apex bank, under Yemi Cardoso, increased the monetary policy rate five times to combat inflation and foster economic stability. The first hike increased the rate from 18.75 per cent to 22.75 per cent, the second to 24.75 per cent, the third to 26.25 per cent, the fourth to 26.75 per cent, and most recently in September 2024, the Monetary Policy Committee raised the rate by 50 basis points to 27.25 per cent. These increases, totalling 850 basis points since Cardoso’s appointment, have been driven by efforts to tackle the country’s persistent inflation challenges, which include high core and food inflation.

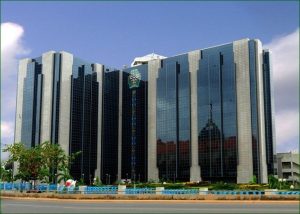

EXTERNAL RESERVES HIT 33-MONTH HIGH – CBN

The Governor of the Central Bank of Nigeria, Mr Olayemi Cardoso, has announced that Nigeria’s foreign exchange reserves have reached over $40bn, marking their highest level in 33 months. He disclosed this at a symposium in Abuja on Thursday, which coincided with the unveiling of the compendium, “Promoting Stability in an Era of Economic Reforms: The Journey So Far”, celebrating the first anniversary of the Bank’s management team. In his keynote address, Cardoso reflected on the significant milestones achieved under his leadership, stating that the reforms initiated by the Bank had begun to yield positive results. According to a press statement on Thursday, Cardoso described the past year as one of transformation, despite the challenging economic environment. The Governor noted that inflation, which had surged to 24.1 per cent by mid-2023, is now on a downward trajectory, signifying the effectiveness of the Bank’s interventions. The statement read, “According to governor Cardoso, the reforms had started to yield positive results, including marked improvements in the FX market and a stabilisation of foreign reserves, which have now surpassed the $40bn mark, the highest in 33 months. “While noting that inflation remained elevated, he said it was on a downward trend, signalling that the reforms were taking hold in restoring market equilibrium and fostering growth.” He attributed these achievements to robust policy measures, including recalibrating the Monetary Policy Rate, which was increased by 850 basis points to 27.25 per cent, and raising the Cash Reserve Ratio for commercial banks to 50 per cent. These measures, he explained, were aimed at curbing inflation and stabilising the economy. Cardoso also highlighted improvements in the foreign exchange market, citing the elimination of multiple exchange rate windows, which had previously created arbitrage opportunities and deterred foreign investment. He noted that this reform alone had addressed a backlog of FX settlements and curtailed revenue losses, estimated at N6.2tn in 2022. The CBN’s drive to increase foreign remittances is another cornerstone of its economic strategy. Governor Cardoso reiterated the Bank’s ambitious target of achieving $1bn in monthly remittances, which he described as critical to bolstering Nigeria’s foreign reserves and enhancing economic stability. He also outlined steps taken to address Nigeria’s declining foreign direct investment and portfolio investments, which had posed challenges for over a decade.

EXPORTERS URGE GOVT INTERVENTION AMID FX CHALLENGES, OTHERS

The Manufacturers Association of Nigeria Export Promotion Group has raised concerns over the challenges plaguing exporters, with key economic indicators continuing to stifle competitiveness. The Chairman of MANEG, Odiri Erewa-Meggison, told The PUNCH about the export sector’s frustration over inflation, high energy costs, and unfavourable exchange rates, describing them as critical hurdles for manufacturers. “In recent times, the situation with our members has not experienced any positive changes as it were,” Erewa-Meggison stated. “The key indicators such as inflation rate, exchange rate, monetary policy rate, and energy cost are still unfriendly to business, making it hard for our members to compete globally.” She highlighted the Central Bank of Nigeria’s recent hike in the Monetary Policy Rate to 26.25 per cent as an additional challenge that limits market competitiveness. Erewa-Meggison appreciated the government’s introduction of the Guided Trade Initiative under the African Continental Free Trade Area in July 2024 but noted that few manufacturers fully understand the details required for successful exportation under the GTI framework. “Most manufacturers are yet to be fully abreast with details on how to export under the GTI,” the MANEG chairman remarked, calling for increased training and sensitisation to enable Nigerian exporters to harness the benefits of the AfCFTA. Erewa-Meggison also addressed the impact of border policies, stating that the recent reopening of the Nigeria-Niger border has offered significant relief for manufacturers who trade across the axis. However, she flagged logistical obstacles, including multiple checkpoints and high transport costs, which continue to hamper operations. “The closure of the Nigeria-Niger border impaired our members’ export business to a large extent. The reopening is beneficial, but exporters still face challenges,” she added. The National Bureau of Statistics’ recent report on Foreign Trade in Goods (Q2 2024) paints a similar picture. Although Nigeria’s total trade increased by 150.39 per cent year-on-year in the second quarter of 2024 to N31.89tn, non-oil exports contributed a modest N1.94tn or just 10 per cent of total exports.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026