OIL FIRMS, DANGOTE SIGN DEAL FOR AFFORDABLE PETROL SUPPLY

The Dangote Petroleum Refinery says Heyden Petroleum and Ardova Plc have joined it to ensure the supply of affordable Premium Motor Spirit (petro) in Nigeria. The Dangote refinery in a statement on Thursday, said the two companies, propelled by the economic relief provided by President Bola Tinubu’s crude-for-naira swap initiative, entered into a bulk purchase agreement with the refinery. “This strategic move is designed to ensure a steady supply of petroleum products at affordable prices, further stabilising the nation’s fuel market and enhancing energy security for consumers,” the statement read partly. According to the company, the development followed the example set by MRS Oil Nigeria Plc, which had previously entered into a similar agreement with Dangote Refinery. As a result, MRS Oil recently lowered its fuel prices to N935 per litre across all its stations nationwide, addressing the long-standing issue of price disparities between states. “Furthermore, MRS Oil’s stock surged to a new 52-week high last Friday, as investors became increasingly optimistic about the company’s future earnings prospects,” Dangote stated in its statement. The statement disclosed that the bulk purchase agreement with Dangote refinery will enable both Ardova and Heyden to secure a reliable and consistent supply of petroleum products from the world’s largest single-train refinery.

NGX UNVEILS NEW INDEX

The Nigerian Exchange has launched the Equity-Based Commodity Index, a market commodity index designed to track the performance of companies primarily operating in the energy, agriculture, mining, metals, and natural resources sectors. The starting constituents of the index include Geregu Power Plc, Multiverse Mining and Exploration Plc, Okomu Oil Palm Plc, Presco Plc, Seplat Energy Plc, Transcorp Power Plc, and Aradel Holdings Plc. The initial value of the NGX Equity-Based Commodity Index is set at 1,000. In addition to launching the new index, the Nigeria Exchange Limited also provided updates on the changes in its incoming and existing indices. In the NGX 30 Index, which tracks the largest and most liquid companies, Conoil Plc, International Breweries Plc, Oando Plc, and Transcorp Power Plc are the incoming constituents. However, Guinness Nigeria Plc, Sterling Holding Company Plc, Total Nigeria Plc, and Flour Mills Nigeria Plc will be exiting the index. The NGX Consumer Goods Index will see Golden Guinea Breweries Plc added to its list of constituents, while Flour Mills Nigeria Plc will exit. For the NGX Banking Index, Wema Bank Plc has been included, while Sterling Holding Company Plc will be removed.

NINE BANKS RAKE IN N4.8TN ON LOAN CHARGES

Nine Nigerian banks collectively earned N4.85tn in interest income on loans and advances to customers in the first nine months of 2024, marking a growth of 114.95 per cent compared to N2.26tn recorded in the same period of 2023. Access Holdings led the industry with N1.13tn in interest income as of September 2024, up from N458.41bn in the corresponding period of 2023. The 146.4 per cent surge reflects the bank’s lending strategy and expansion of its loan portfolio. Zenith Bank followed closely, reporting an interest income of N1.07tn, more than doubling its N408.66bn figure from the previous year, representing an increase of 161.8 per cent. FBN Holdings earned N915.35bn in interest income year-to-date in 2024, a 128.1 per cent increase from N401.33bn recorded in the same period of 2023. Fidelity Bank recorded an interest income of N450.00bn, up from N260.51bn in 2023. The 72.7 per cent growth reflects the bank’s efforts to deepen its presence in the corporate and retail lending markets. Guaranty Trust Holding Company reported an interest income of N392.33bn, an 84.8 per cent rise from N212.30bn in the prior year. FCMB Group generated N317.53bn in interest income, up from N183.55bn in 2023. This 73 per cent increase is attributed to its targeted approach to scaling its credit portfolio to meet customer needs.

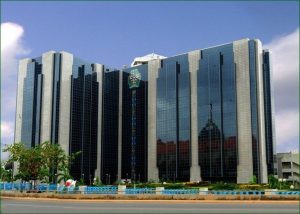

NAIRA WEAKENS TO 1,541/$

The Nigerian naira weakened to N1,541.36/$ on the first day of trading in the New Year. According to the NFEM rate data available on the website of the Central Bank of Nigeria, this is a 0.36 per cent depreciation compared to the closing rate of 2024 which was N1,535.82/$. Some authorised dealers quoted the dollar at N1,545/$, an improvement compared to the N1,550/$ quoted on Tuesday while others quoted the naira at N1520/$ at the close of trading on Thursday. At the parallel market, the naira closed trading at N1,655/$ compared to N1670/$ on Tuesday. The naira had recorded a 40.9 per cent depreciation in 2024 when compared to the official rate at the close of 2023, which stood at 907.11/$. The significant depreciation comes amid the CBN’s introduction of several foreign exchange policies aimed at enhancing market transparency and attracting foreign investors. The latest reform was the introduction of the Electronic Foreign Exchange Matching System which set new guidelines for authorised Foreign Exchange dealers in December. This introduction saw the naira gain some semblance of stability. Meanwhile, in the money market, the Nigerian Interbank Offered Rate experienced downward movements across all maturities, signalling liquidity in the banking system. However, the Open Repo Rate fell by 0.61 per cent to 26.69 per cent, while the Overnight Lending Rate decreased by 0.55 per cent to 27.25 per cent.

EQUITY MARKET OPENS YEAR WITH N155BN GAIN

The equity market began 2025 on a positive note, with the Nigerian Exchange recording a gain of N155bn as the All Share Index appreciated by 0.25 per cent. The index closed at 103,180.14 points, up from 102,926.40, marking year-to-date, month-to-date, and week-to-date gains of 0.25 per cent, 0.25 per cent, and 1.02 per cent, respectively. Also, the market capitalisation also rose to N62.918tn, resulting in an aggregate of 829.75m unit shares traded in 11,752 deals valued at N5.67bn. The market breadth was positive, with 58 equities recording gains against 8 decliners. Leading the gainers, National Cash Register, RT Briscoe, Cutix, International Energy Insurance plc, and Mansard all appreciated by 10.00 per cent, closing at N5.50, N2.75, N2.53, N1.87, and N9.02, respectively. On the decliners’ list, Ellah Lakes led with a 4.75 per cent drop to close at N3.01, followed by NASCON and CWG, which fell by 4.31 per cent and 3.25 per cent to close at N30.00 and N7.45, respectively. In terms of trading volume, Royal Exchange led the pack with 290.99m shares worth N318.64m, followed by Chams with 63.68m shares and AIICO with 58.60m shares.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026