FUEL IMPORTERS FACE N75BN MONTHLY LOSS AFTER DANGOTE PRICE CUT

Importers of Premium Motor Spirit (petrol) may lose an average of N2.5bn daily and N75bn monthly following the latest PMS price reduction announced by the Dangote Petroleum Refinery. Findings by The Punch revealed that the average landing cost of petrol as released by industry players is over N100 higher than the new ex-depot price of petrol at the Dangote refinery. The Dangote refinery announced a reduction in the ex-depot (gantry) price of petrol by N65, from N890 to N825 per litre, effective from Wednesday, February 27. This was the second price reduction in the new year, and the third one in a space of two months. It disclosed that Nigerians will now buy at new prices from its partners nationwide, including MRS, Heyden, and Ardova. “Nigerians will be able to purchase the high-quality Dangote petrol at the following prices in all our partners’ retail outlets. For MRS Holdings stations, it will sell for N860 per litre in Lagos, N870 per litre in the South-West, N880 per litre in the North, and N890 per litre in the South-South and South-East, respectively. “The same product will also be available at the following prices in Ardova Petroleum and Heyden stations: N865 per litre in Lagos, N875 per litre in the South-West, N885 per litre in the North, and N895 per litre in the South-South and South-East,” the company said.

FOREIGN INVESTORS WITHDREW N45.8BN FROM NGX IN JANUARY – REPORT

Foreign investors withdrew N45.85bn from the Nigerian stock market in January 2025, an outflow that significantly overshadowed the N25.66bn recorded as foreign inflows within the same period. The latest Nigerian Exchange Domestic and Foreign Portfolio Investment Report revealed that foreign outflows accounted for 64.12 per cent of total foreign transactions on the exchange, reinforcing concerns over declining foreign participation in the market despite the relative stability of the naira. It showed that total foreign transactions increased by 7.13 per cent, rising from N66.75bn in December 2024 to N71.51bn in January 2025. However, this increase was largely driven by investors liquidating their holdings, as evidenced by the much larger outflow compared to inflows. This trend indicates that while some foreign investors may still engage with the Nigerian market, a greater proportion opt to exit, contributing to capital flight. The withdrawal of foreign funds from the market came amid a 9.89 per cent decline in total equity transactions on the NGX, which fell from N673.66bn in December 2024 to N607.05bn in January 2025. On a year-on-year basis, total transactions dropped by 6.83 per cent from N651.52bn recorded in January 2024.

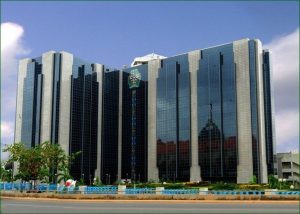

BANKING SYSTEM LIQUIDITY REBOUNDS TO N572.8BN – REPORT

Liquidity in Nigeria’s banking system witnessed a recovery in February, surging to N572.8bn from an N307.5bn deficit recorded in January, according to a report by Afrinvest.The improvement was largely driven by substantial inflows from primary market repayments, open market operations repayments, and standing lending facility transactions, which outpaced outflows from OMO sales, primary market auctions, and the standing deposit facility. A standing lending facility is a short-term loan that a central bank provides to commercial banks. A Standing Deposit Facility is a financial instrument employed by central banks to regulate liquidity within the financial system. Open market operation is a term that refers to any of the purchases and sales of government securities and sometimes commercial paper by the central banking authority for the purpose of regulating the money supply. Afrinvest stated that “inflows from primary market repayment stood at N2.9tn, OMO repayment at N823.3bn, and SLF at N24.2tn. These outweighed the outflows via OMO sales (N1.4tn), PMAs (N1.4tn), and SDF (N4.2tn), leading to a net positive liquidity position.” As a result of the improved liquidity, the open repo rate and overnight rate declined by 2.4 per cent and 2.2 per cent month-on-month to 26.8 per cent and 27.3 per cent, respectively.

EQUITY MARKET RECORDS N421BN LOSS IN ONE WEEK

The Nigerian Exchange suffered a N421bn loss last week as sustained bearish sentiment pushed the All-Share Index down by 0.62 per cent to close at 107,821.39 points. Investor activity slowed, with a total of 1.85bn shares worth N51.39bn traded in 63,090 deals, compared to 2bn shares valued at N49.49bn exchanged in 70,853 deals the previous week. The Financial Services Industry led trading with 1.3 billion shares valued at N26.91bn in 29,140 deals, accounting for 70.13 per cent of total equity turnover volume and 52.38 per cent of the value. The services industry followed with 129.44 million shares worth N719.22m in 3,657 deals, while the consumer goods industry recorded 116.70 million shares valued at N4.19bn in 7,452 deals. Zenith Bank Plc, FCMB Group Plc, and Access Holdings Plc were the most traded stocks, contributing 539.77m shares worth N16.53bn in 7,392 deals, representing 29.21 per cent and 32.16 percent of total equity turnover volume and value, respectively. Market capitalisation declined to N67.19tn, with most indices finishing lower except for AseM, Oil & Gas, Lotus II, Sovereign Bond, and Commodity, which recorded marginal gains of 0.04 per cent, 0.60 per cent, 0.33 per cent, 0.81 per cent, and 0.53 per cent, respectively.

NAIRA DEFIES PRESSURE, ENDS FEBRUARY BELOW N1,500 PER DOLLAR

Naira closed February 2025 with an 8.5 per cent gain month-on-month on the parallel market to settle at 1,490/$, while it closed at 1,500/$ on the official market, indicating a 1.7 per cent m/m decline. According to the Afrinvest Monthly Market Report, the foreign reserve dipped by 3.2 per cent month-on-month. As of Thursday, it stood at $38.46bn. “This decline can be linked to CBN’s efforts to stabilise the naira, particularly through the resumption of payments for the verified portion of the outstanding $7.0bn foreign exchange backlog,” the analysts said. They went on to project that “in March, we anticipate the naira will maintain its positive performance across FX segments, supported by the CBN’s continued USD supply to BDCs and DMBs, provided there are no adverse market shocks.” In the foreign exchange market, the naira had exhibited mild strength against the American greenback and hovered around the N1,500 band at both segments of the market in recent times. Highlighting the factors driving the market, Cowry Asset Research said in the past week, the Nigerian oil benchmark, Bonny Light crude, traded in a weak region at the international oil market, shedding $2.36, or 3.2%, week-on-week to close at $75.88 per barrel as of Thursday.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026