OIL PRODUCTION FELL IN Q2

Nigeria’s daily oil production shrank by 160,000 barrels per day in the second quarter of 2024. This was contained in a report released by the National Bureau of Statistics. Within these three months, the NBS stated that the country recorded an average daily production of 1.41 million barrels per day. This is lower than the first quarter’s production volume of 1.57mbpd. However, it is higher than the daily average production of 1.22 mbpd recorded in the same quarter of 2023 by 190,000 barrels. “The nation in the second quarter of 2024 recorded an average daily oil production of 1.41 million barrels per day, higher than the daily average production of 1.22mbpd recorded in the same quarter of 2023 by 0.19mbpd and lower than the first quarter of 2024 production volume of 1.57 mbpd by 0.16mbpd,” the NBS report disclosed. The nation’s oil output has continued to dwindle since 2020, when production fell from close to 2mbpd to 1.6mbpd Between 2018 and 2019, daily oil output quarterly averaged 2 million barrels. In the second quarter of 2020, the output dropped to 1.81mbpd, followed by 1.67mbpd in the third quarter. The slope has since continued to fall until it dipped to 1.2mbpd in Q2 2022. Since then, the efforts of the government to ramp up production have not yielded the desired result, especially in the face of unrelenting oil thieves and vandals. As a result, Nigeria has not been able to meet the 1.5mbpd quota allocated to it by the Organisation of the Petroleum Exporting Countries.

BANKS DOMINATE TRADING AS INVESTORS EYE HIGHER DIVIDENDS

The Nigerian stock market continued its rally, with banking stocks leading the way, contributing over N2.62bn during Tuesday’s trading session. Market analysts told The PUNCH that investors were showing renewed interest in banking equities as they hoped for higher dividends from banks. A financial analyst, Ambrose Omorodion, suggested that the recent uptick in banking sector stocks might be driven more by expectations of higher dividend payouts than by the recapitalisation process. According to him, the improved performance of banking stocks reflects investor anticipation of increased dividends this year, rather than changes resulting from recapitalization. “I do not think the recapitalisation process is the primary factor. I believe expectations of increased dividend payouts this year are driving the improvement in banking sector values,” Omorodion added. In a phone chat with The PUNCH, the National Coordinator of the Progressive Shareholders Association of Nigeria, Boniface Okezie, noted that the primary influence on the banking stocks’ performance might be investors’ anticipation for higher dividends. He noted that investors were focusing on the fourth-quarter results and the possibility of higher dividend payments, which was driving current trading activity and stock values. “The recent trading activity might be influenced by the recapitalisation process, or it could be due to anticipated dividend increases

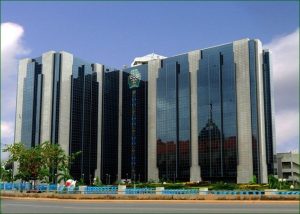

CURRENCY OUTSIDE BANKS DROPS TO N3.66TN — CBN REPORT

Currency held outside of Nigeria’s banking system dropped to N3.66tn in July, about 3.32 per cent lower than it was in the previous month. This was disclosed in Money and Credit data available on the website of the Central Bank of Nigeria. This showed that the amount outside banks dropped to 90.39 per cent from 93.59 per cent of the currency in circulation recorded in June 2024.The value of currency in circulation rose in July to N4.05tn from N4.04tn From the beginning of the year, the amount of money in circulation rose by 11.05 per cent compared to 56.17 per cent rise in the same period in 2023. Members of the Monetary Policy Committee of the Central Bank of Nigeria have blamed the excess cash in circulation for the accelerating inflation in the country. Also, money supply (M3), which is a broad measure of the total amount of money in an economy, hit a high of N106.27tn in July 2024, amid tightening measures by the CBN. The apex bank has maintained a hawkish stance in a bid to rein in inflation. At its last Monetary Policy Committee meeting in July 2024, the CBN raised the MPR by 50 basis points to 26.75 percent from 26.25 in June 2024.

EQUITY MARKET REVERSES LOSS WITH N117BN GAIN

The Nigerian Stock Exchange reversed its previous day’s loss, as investors gained N117bn on Thursday. The market capitalisation and the all-share index gained 0.21 per cent to close at N55.4tn and 96,407.88, respectively. Investors exchanged 966.97 million shares valued at N7.42bn in 9,851 deals, a 117 per cent increase in volume and a 64 per cent rise in turnover. Additionally, a total of 123 equities were traded, with 27 gaining and 23 declining. Oando led the gainers with a 9.98 per cent rise, closing at N69.95 per share, while Julius Berger Nigeria and Cornerstone Insurance also gained 9.97 per cent and 9.88 per cent, respectively. SCOA Nigeria suffered the largest decline, dropping 9.79 per cent to close at N1.75 per share. Japaul Gold and Ventures followed closely, shedding 7.41 per cent to settle at N2.50; Tantalizer declined by 6.76 per cent to 69 kobo and Fidson Healthcare shed 5.45 per cent to N13.00. Consolidated Hallmark Holdings recorded the highest trading volume, with 506 million shares changing hands, followed by FBN Holdings with 64.1 million shares and Access Holdings with 46.9 million shares.

74% EXPECTED CBN RATE CUT IN JULY

About 74.2 per cent of respondents to the inflation expectations survey conducted by the Statistics Department of the CBN believed that the apex bank should have reduced the interest rate in July.This is in contrast to 12.4 per cent who thought that the interest rate should be raised, while 13.4 per cent preferred that the rates remain unchanged. The survey results were released by the CBN recently on its website. At its last meeting, the Monetary Policy Committee of the CBN raised the benchmark rate by 50 basis points to 26.75 per cent, the fourth increase in seven months. The CBN Governor, Olayemi Cardoso, said the hike was in response to the continued inflationary pressures. He explained that while the CBN was concerned about the impact of the high interest rate environment on Nigerians and businesses, it was important to maintain its inflation-tightening stance. Also, businesses and households surveyed believed that the July inflation rate was high, with most of the respondents believing that changes in the price of energy, exchange rate and transportation were the major drivers of inflation in July. Nigeria’s inflation moderated to 33.40 per cent in July from 34.19 per cent in the previous month, according to the National Bureau of Statistics. The central bank said that the survey for July was conducted from July 14-26, among selected businesses and households with a sample of 1,600 and 1,650 respectively, in the 36 states of the federation and the Federal Capital Territory.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026February 2, 2026

Enter your email address for receiving valuable newsletters.

- CAPITALDIGEST MARKET REVIEW, 09/02/2026U.S. DOLLAR REBOUND TO BE CUT SHORT BY RATE CUT BETS, DOUBTS OVER FED INDEPENDENCE:...February 9, 2026

- CAPITALDIGEST DAILYNEWS, 09/02/2026TAXES, FUEL HIKE SLOW BUSINESS GROWTH IN JANUARY – NESG REPORT The report showed that...February 9, 2026

- CAPITALDIGEST MARKET REVIEW, 02/02/2026DOLLAR WEAKENS ACROSS THE BOARD AS YEN CLIMBS ON INTERVENTION RISK The dollar moved sharply...February 2, 2026